Market Summary

AMZN Stock Price

AMZN RSI Chart

AMZN Valuation

AMZN Price/Sales (Trailing)

AMZN Profitability

AMZN Fundamentals

AMZN Revenue

AMZN Earnings

Breaking Down AMZN Revenue

Last 7 days

6.4%

Last 30 days

2.2%

Last 90 days

7.5%

Trailing 12 Months

78.2%

How does AMZN drawdown profile look like?

AMZN Financial Health

AMZN Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 590.7B | 0 | 0 | 0 |

| 2023 | 524.9B | 538.0B | 554.0B | 574.8B |

| 2022 | 477.7B | 485.9B | 502.2B | 514.0B |

| 2021 | 419.1B | 443.3B | 458.0B | 469.8B |

| 2020 | 296.3B | 321.8B | 347.9B | 386.1B |

| 2019 | 241.5B | 252.1B | 265.5B | 280.5B |

| 2018 | 193.2B | 208.1B | 221.0B | 232.9B |

| 2017 | 142.6B | 150.1B | 161.2B | 177.9B |

| 2016 | 113.4B | 120.6B | 128.0B | 136.0B |

| 2015 | 92.0B | 95.8B | 100.6B | 107.0B |

| 2014 | 78.1B | 81.8B | 85.2B | 89.0B |

| 2013 | 64.0B | 66.8B | 70.1B | 74.5B |

| 2012 | 61.1B | 61.1B | 61.1B | 61.1B |

| 2011 | 40.3B | 46.5B | 52.8B | 61.1B |

| 2010 | 26.8B | 28.7B | 30.8B | 34.2B |

| 2009 | 19.9B | 20.5B | 21.7B | 24.5B |

| 2008 | 0 | 16.3B | 17.7B | 19.2B |

| 2007 | 0 | 0 | 0 | 14.8B |

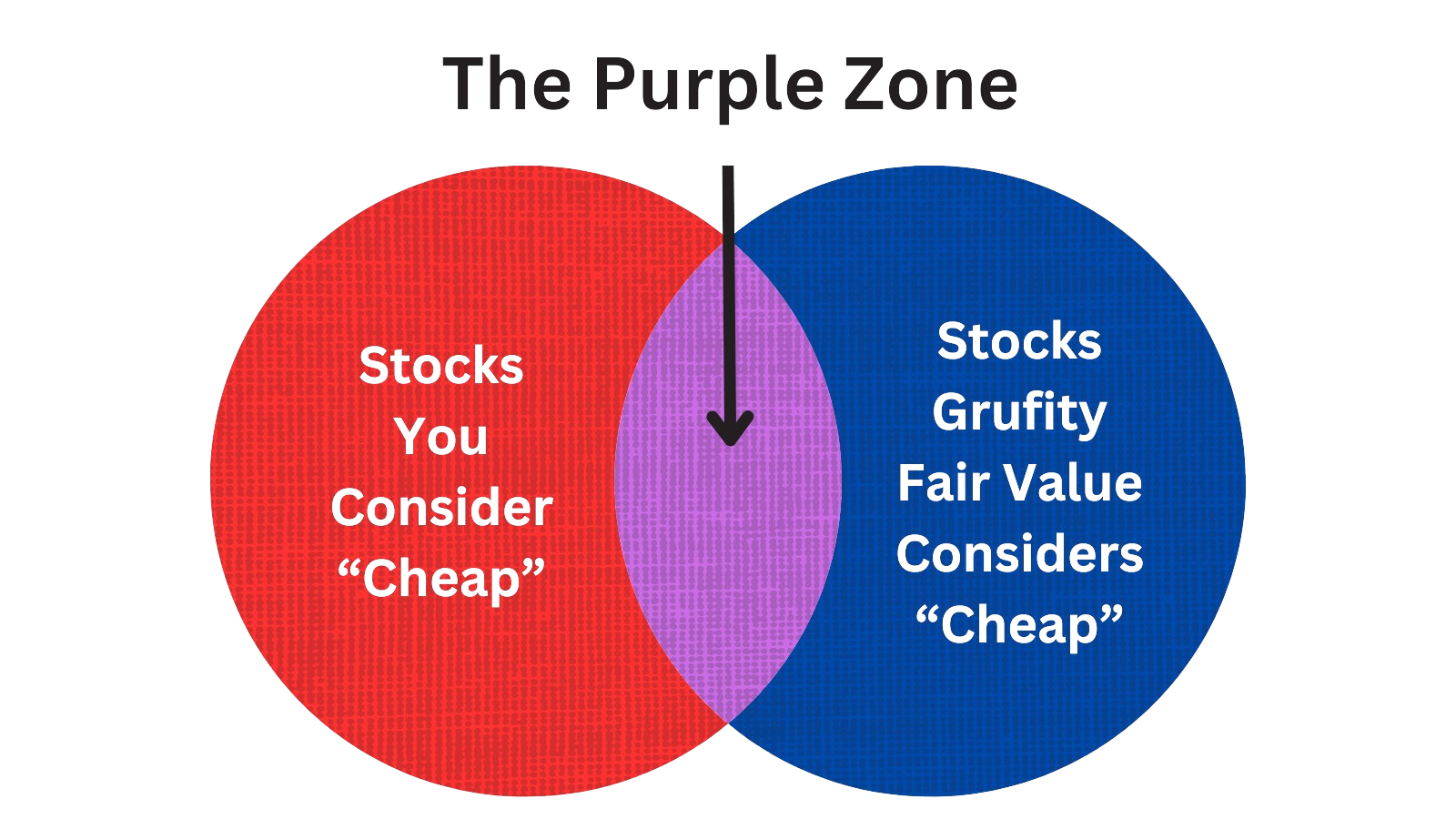

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of Amazon.com

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| Apr 19, 2024 | selipsky adam | sold | -89,500 | 179 | -500 | ceo amazon web services |

| Apr 18, 2024 | selipsky adam | sold | -90,690 | 181 | -500 | ceo amazon web services |

| Apr 05, 2024 | selipsky adam | sold | -91,265 | 182 | -500 | ceo amazon web services |

| Apr 04, 2024 | selipsky adam | sold | -92,000 | 184 | -500 | ceo amazon web services |

| Apr 01, 2024 | herrington douglas j | sold | -632,555 | 180 | -3,500 | ceo worldwide amazon stores |

| Mar 22, 2024 | selipsky adam | sold | -88,790 | 177 | -500 | ceo amazon web services |

| Mar 21, 2024 | selipsky adam | sold | -90,000 | 180 | -500 | ceo amazon web services |

| Mar 08, 2024 | selipsky adam | sold | -88,155 | 176 | -500 | ceo amazon web services |

| Mar 07, 2024 | selipsky adam | sold | -87,405 | 174 | -500 | ceo amazon web services |

| Mar 04, 2024 | bezos jeffrey p | gifted | - | - | -227,561 | executive chair |

Which funds bought or sold AMZN recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 01, 2024 | Harbor Advisors LLC | unchanged | - | 4,379,760 | 27,778,500 | 5.10% |

| May 01, 2024 | BOK Financial Private Wealth, Inc. | reduced | -6.81 | 776,707 | 8,085,170 | 0.60% |

| May 01, 2024 | Capital Investment Counsel, Inc | reduced | -14.87 | 187,190 | 17,814,500 | 3.07% |

| May 01, 2024 | FIRST INTERSTATE BANK | reduced | -5.19 | 2,074,380 | 18,588,000 | 1.29% |

| May 01, 2024 | LATHROP INVESTMENT MANAGEMENT CORP | added | 11.78 | 149,000 | 604,000 | 0.12% |

| May 01, 2024 | REDW Wealth LLC | added | 0.41 | 433,422 | 2,690,190 | 0.72% |

| May 01, 2024 | Parkside Financial Bank & Trust | added | 3.9 | 1,820,570 | 9,617,630 | 1.54% |

| May 01, 2024 | Janney Montgomery Scott LLC | added | 1.28 | 74,099,000 | 440,356,000 | 1.31% |

| May 01, 2024 | Kranot Hishtalmut Le Morim Ve Gananot Havera Menahelet LTD | added | 3.06 | 5,340,320 | 29,085,200 | 2.53% |

| May 01, 2024 | OAK RIDGE INVESTMENTS LLC | added | 4.3 | 9,407,900 | 48,905,100 | 4.93% |

Are Funds Buying or Selling AMZN?

Unveiling Amazon.com's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 13, 2024 | vanguard group inc | 7.46% | 771,052,550 | SC 13G/A | |

| Feb 12, 2024 | blackrock inc. | 6.1% | 630,188,686 | SC 13G/A | |

| Jan 26, 2024 | bezos jeffrey p | 11.5% | 1,189,047,364 | SC 13G/A | |

| Feb 09, 2023 | vanguard group inc | 6.98% | 712,070,069 | SC 13G/A | |

| Feb 06, 2023 | blackrock inc. | 5.8% | 596,106,284 | SC 13G/A | |

| Jan 27, 2023 | bezos jeffrey p | 12.3% | 1,258,689,760 | SC 13G/A | |

| Mar 11, 2022 | blackrock inc. | 5.7% | 28,764,843 | SC 13G/A | |

| Feb 09, 2022 | vanguard group inc | 6.59% | 33,421,754 | SC 13G/A | |

| Feb 08, 2022 | blackrock inc. | 5.7% | 28,764,843 | SC 13G | |

| Jan 28, 2022 | bezos jeffrey p | 12.7% | 64,823,570 | SC 13G/A |

Recent SEC filings of Amazon.com

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 02, 2024 | PX14A6G | PX14A6G | |

| May 02, 2024 | PX14A6G | PX14A6G | |

| May 02, 2024 | PX14A6G | PX14A6G | |

| May 01, 2024 | 10-Q | Quarterly Report | |

| May 01, 2024 | PX14A6G | PX14A6G | |

| Apr 30, 2024 | 8-K | Current Report | |

| Apr 29, 2024 | 13F-HR | Fund Holdings Report | |

| Apr 25, 2024 | PX14A6G | PX14A6G | |

| Apr 25, 2024 | PX14A6G | PX14A6G | |

| Apr 22, 2024 | 4 | Insider Trading |

- …

Peers (Alternatives to Amazon.com)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

AMZN | 1.9T | 590.7B | 2.23% | 78.22% | 37.11 | 3.25 | 12.54% | 3929.98% |

MELI | 76.3B | 14.5B | -0.43% | 17.66% | 77.36 | 5.28 | 37.35% | 104.77% |

CPNG | 40.1B | 24.4B | 23.42% | 32.74% | 29.48 | 1.64 | 18.46% | 1578.26% |

EBAY | 25.0B | 10.2B | -4.76% | 10.32% | 9.47 | 2.46 | 3.42% | 312.83% |

OSTK | 932.0M | 1.6B | -40.36% | -94.87% | -3.03 | 0.6 | -19.08% | -773.66% |

| MID-CAP | ||||||||

W | 7.0B | 12.0B | -8.02% | 87.22% | -11.14 | 0.59 | -0.34% | 53.84% |

ETSY | 6.9B | 2.8B | -9.02% | -40.08% | 23.42 | 2.52 | 4.78% | 141.94% |

CHWY | 6.8B | 11.1B | 1.14% | -50.25% | 172.95 | 0.61 | 10.17% | -20.68% |

| SMALL-CAP | ||||||||

LQDT | 545.3M | 313.5M | -4.05% | 34.88% | 28.82 | 1.74 | 9.76% | -53.51% |

APRN | 85.5M | 424.9M | 1.09% | -47.71% | -0.77 | 0.2 | -7.36% | -22.95% |

NHTC | 80.0M | 43.0M | -0.71% | 27.29% | 160.4 | 1.86 | -13.01% | -26.07% |

PRTS | 72.4M | 675.7M | -20.00% | -69.52% | -8.81 | 0.11 | 2.13% | -764.67% |

Amazon.com News

Amazon.com Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | -15.7% | 143,313 | 169,961 | 143,083 | 134,383 | 127,358 | 149,204 | 127,101 | 121,234 | 116,444 | 137,412 | 110,812 | 113,080 | 108,518 | 125,555 | 96,145 | 88,912 | 75,452 | 87,437 | 69,981 | 63,404 | 59,700 |

| Costs and Expenses | -18.3% | 128,006 | 156,752 | 131,895 | 126,702 | 122,584 | 146,467 | 124,576 | 117,917 | 112,775 | 133,952 | 105,960 | 105,378 | 99,653 | 118,682 | 89,951 | 83,069 | 71,463 | 83,557 | 66,824 | 60,320 | 55,280 |

| S&GA Expenses | -100.0% | - | 3,010 | 2,561 | 3,202 | 3,043 | 3,333 | 3,061 | 2,903 | 2,594 | 2,525 | 2,153 | 2,158 | 1,987 | 1,968 | 1,668 | 1,580 | 1,452 | 1,412 | 1,348 | 1,270 | 1,173 |

| EBITDA Margin | 7.4% | 0.17* | 0.16* | 0.13* | 0.12* | 0.10* | 0.07* | 0.10* | 0.11* | 0.13* | 0.16* | 0.14* | 0.15* | - | - | - | - | - | - | - | - | - |

| Interest Expenses | -9.7% | 644 | 713 | 806 | 840 | 823 | 694 | 617 | 584 | 472 | 482 | 493 | 435 | 399 | 414 | 428 | 403 | 402 | 455 | 396 | 383 | 366 |

| Income Taxes | -18.4% | 2,500 | 3,062 | 2,306 | 804 | 948 | -1,227 | 69.00 | -637 | -1,422 | 612 | 1,155 | 868 | 2,156 | 566 | 569 | 984 | 744 | 786 | 494 | 257 | 836 |

| Earnings Before Taxes | -5.1% | 12,983 | 13,686 | 12,189 | 7,563 | 4,119 | -962 | 2,944 | -2,653 | -5,265 | 14,934 | 4,315 | 8,634 | 10,268 | 7,765 | 6,809 | 6,221 | 3,383 | 4,053 | 2,632 | 2,889 | 4,401 |

| EBT Margin | 20.3% | 0.08* | 0.07* | 0.04* | 0.03* | 0.01* | -0.01* | 0.02* | 0.02* | 0.05* | 0.08* | 0.07* | 0.08* | - | - | - | - | - | - | - | - | - |

| Net Income | -57.8% | 10,431 | 24,741 | 9,879 | 6,750 | -1,349 | -847 | 2,872 | -2,028 | -1,593 | 18,584 | 3,156 | 7,778 | -414 | 7,222 | 6,331 | 5,243 | 2,535 | 3,268 | 2,134 | 2,625 | 3,561 |

| Net Income Margin | 25.9% | 0.09* | 0.07* | 0.03* | 0.01* | 0.00* | 0.00* | 0.04* | 0.04* | 0.06* | 0.06* | 0.04* | 0.05* | - | - | - | - | - | - | - | - | - |

| Free Cashflow | -57.8% | 17,128 | 40,604 | 19,356 | 14,615 | 2,927 | 27,312 | 9,543 | 7,104 | -4,651 | 20,225 | 5,452 | 10,854 | - | - | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | 0.6% | 530,969 | 527,854 | 502,731 | 477,607 | 464,378 | 462,675 | 441,202 | 419,728 | 410,767 | 420,549 | 390,434 | 360,319 | 323,077 | 321,195 | 282,179 | 258,314 | 221,238 | 225,248 | 199,099 | 191,351 | 178,102 |

| Current Assets | -4.9% | 163,989 | 172,351 | 12,086 | 140,482 | 136,221 | 146,791 | 14,424 | 133,667 | 133,876 | 161,580 | 5,345 | 140,848 | 121,408 | 132,733 | 112,969 | 110,908 | 85,985 | 96,334 | 79,054 | 76,790 | 69,431 |

| Cash Equivalents | -0.1% | 73,332 | 73,387 | 49,605 | 50,067 | 49,734 | 53,888 | 35,178 | 37,700 | 36,599 | 36,477 | 30,177 | 40,667 | 34,155 | 42,377 | 30,202 | 37,842 | 27,505 | 36,410 | 23,554 | 22,965 | 23,507 |

| Inventory | -6.5% | 31,147 | 33,318 | 35,406 | 36,587 | 34,170 | 34,405 | 36,647 | 38,153 | 34,987 | 32,640 | 30,933 | 24,119 | 23,849 | 23,795 | 23,735 | 19,599 | 18,857 | 20,497 | 18,766 | 18,580 | 16,432 |

| Net PPE | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 99,981 | 86,517 | 77,779 | 72,705 | 67,662 | 64,723 | 61,048 |

| Goodwill | -0.1% | 22,770 | 22,789 | 22,749 | 22,785 | 22,749 | 20,288 | 20,168 | 20,195 | 4,900 | 15,371 | 15,345 | 15,350 | 15,220 | 15,017 | 14,960 | 14,751 | 14,739 | 14,754 | 14,734 | 14,727 | 14,708 |

| Current Liabilities | -7.2% | 152,965 | 164,917 | 2,624 | 148,238 | 147,570 | 155,393 | 2,109 | 140,291 | 139,508 | 142,266 | 1,047 | 117,792 | 115,404 | 126,385 | 101,912 | 93,896 | 79,711 | 87,812 | 72,136 | 69,678 | 63,695 |

| Long Term Debt | -1.2% | 57,634 | 58,314 | 61,098 | 63,092 | 67,084 | 67,150 | 58,919 | 58,053 | 47,556 | 48,744 | 50,055 | 50,279 | 31,868 | 31,816 | 32,929 | 33,128 | 23,437 | 23,414 | 22,472 | 23,329 | 23,322 |

| LT Debt, Non Current | -100.0% | - | 58,314 | 61,098 | 63,092 | 67,084 | 67,150 | 58,919 | 58,053 | 47,556 | 48,744 | 50,055 | 50,279 | 31,868 | 31,816 | 32,929 | 33,128 | 23,437 | 23,414 | 22,472 | 23,329 | 23,322 |

| Shareholder's Equity | 7.3% | 216,661 | 201,875 | 182,973 | 168,602 | 154,526 | 146,043 | 137,489 | 131,402 | 134,001 | 138,245 | 120,564 | 114,803 | 103,320 | 93,404 | 82,775 | 73,728 | 65,272 | 62,060 | 56,508 | 53,061 | 48,410 |

| Retained Earnings | 9.2% | 124,049 | 113,618 | 102,994 | 93,115 | 86,365 | 83,193 | 82,915 | 80,043 | 82,071 | 85,915 | 71,592 | 68,436 | 60,658 | 52,551 | 45,329 | 38,998 | 33,755 | 31,220 | 27,952 | 25,818 | 23,193 |

| Additional Paid-In Capital | 5.0% | 103,938 | 99,025 | 92,711 | 86,896 | 79,863 | 75,066 | 69,419 | 63,871 | 58,793 | 55,437 | 51,879 | 48,724 | 45,160 | 42,865 | 40,307 | 38,017 | 35,412 | 33,658 | 31,817 | 30,035 | 28,059 |

| Shares Outstanding | 0.2% | 10,403 | 10,383 | 10,330 | 10,313 | 10,258 | 10,242 | 10,191 | 10,175 | 10,171 | 10,117 | 10,103 | 10,089 | - | - | - | - | - | - | - | - | - |

| Float | - | - | - | - | 1,183,685 | - | - | - | 944,744 | - | - | - | 1,507,363 | - | - | - | 1,174,368 | - | - | - | 786,284 | - |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | -55.3% | 18,989 | 42,465 | 21,217 | 16,476 | 4,788 | 29,173 | 11,404 | 8,965 | -2,790 | 22,086 | 7,313 | 12,715 | 4,213 | 30,431 | 11,964 | 20,606 | 3,064 | 19,659 | 7,892 | 9,118 | 1,846 |

| Share Based Compensation | -21.5% | 4,961 | 6,319 | 5,829 | 7,127 | 4,748 | 5,606 | 5,556 | 5,209 | 3,250 | 3,680 | 3,180 | 3,591 | 2,306 | 2,562 | 2,288 | 2,601 | 1,757 | 1,840 | 1,779 | 1,971 | 1,274 |

| Cashflow From Investing | -41.8% | -17,862 | -12,601 | -11,753 | -9,673 | -15,806 | -10,821 | -15,608 | -12,078 | 906 | -12,580 | -14,828 | -22,080 | -8,666 | -17,037 | -15,876 | -17,804 | -8,894 | -3,535 | -5,074 | -7,549 | -8,123 |

| Cashflow From Financing | 81.4% | -1,256 | -6,746 | -8,948 | -6,539 | 6,354 | 86.00 | 3,016 | 4,626 | 1,990 | -3,100 | -2,776 | 15,643 | -3,476 | -1,816 | -4,105 | 7,408 | -2,591 | -3,571 | -1,960 | -2,158 | -2,377 |

| Buy Backs | - | - | - | - | - | - | - | - | 3,334 | 2,666 | - | - | - | - | - | - | - | - | - | - | - | - |

AMZN Income Statement

2024-03-31Consolidated Statements of Operations - USD ($) shares in Millions, $ in Millions | 3 Months Ended | |

|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | |

| Total net sales | $ 143,313 | $ 127,358 |

| Operating expenses: | ||

| Cost of sales | 72,633 | 67,791 |

| Fulfillment | 22,317 | 20,905 |

| Technology and infrastructure | 20,424 | 20,450 |

| Sales and marketing | 9,662 | 10,172 |

| General and administrative | 2,742 | 3,043 |

| Other operating expense (income), net | 228 | 223 |

| Total operating expenses | 128,006 | 122,584 |

| Operating income | 15,307 | 4,774 |

| Interest income | 993 | 611 |

| Interest expense | (644) | (823) |

| Other income (expense), net | (2,673) | (443) |

| Total non-operating expense | (2,324) | (655) |

| Income before income taxes | 12,983 | 4,119 |

| Provision for income taxes | (2,467) | (948) |

| Equity-method investment activity, net of tax | (85) | 1 |

| Net income | $ 10,431 | $ 3,172 |

| Basic earnings per share (in usd per share) | $ 1.00 | $ 0.31 |

| Diluted earnings per share (in usd per share) | $ 0.98 | $ 0.31 |

| Weighted-average shares used in computation of earnings per share: | ||

| Basic (in shares) | 10,393 | 10,250 |

| Diluted (in shares) | 10,670 | 10,347 |

| Product | ||

| Total net sales | $ 60,915 | $ 56,981 |

| Service | ||

| Total net sales | $ 82,398 | $ 70,377 |

AMZN Balance Sheet

2024-03-31Consolidated Balance Sheets - USD ($) $ in Millions | Mar. 31, 2024 | Dec. 31, 2023 |

|---|---|---|

| Current assets: | ||

| Cash and cash equivalents | $ 72,852 | $ 73,387 |

| Marketable securities | 12,222 | 13,393 |

| Inventories | 31,147 | 33,318 |

| Accounts receivable, net and other | 47,768 | 52,253 |

| Total current assets | 163,989 | 172,351 |

| Property and equipment, net | 209,950 | 204,177 |

| Operating leases | 73,313 | 72,513 |

| Goodwill | 22,770 | 22,789 |

| Other assets | 60,947 | 56,024 |

| Total assets | 530,969 | 527,854 |

| Current liabilities: | ||

| Accounts payable | 73,068 | 84,981 |

| Accrued expenses and other | 63,970 | 64,709 |

| Unearned revenue | 15,927 | 15,227 |

| Total current liabilities | 152,965 | 164,917 |

| Long-term lease liabilities | 77,052 | 77,297 |

| Long-term debt | 57,634 | 58,314 |

| Other long-term liabilities | 26,657 | 25,451 |

| Commitments and contingencies (Note 4) | ||

| Stockholders’ equity: | ||

| Preferred stock ($0.01 par value; 500 shares authorized; no shares issued or outstanding) | 0 | 0 |

| Common stock ($0.01 par value; 100,000 shares authorized; 10,898 and 10,918 shares issued; 10,383 and 10,403 shares outstanding) | 109 | 109 |

| Treasury stock, at cost | (7,837) | (7,837) |

| Additional paid-in capital | 103,938 | 99,025 |

| Accumulated other comprehensive income (loss) | (3,598) | (3,040) |

| Retained earnings | 124,049 | 113,618 |

| Total stockholders’ equity | 216,661 | 201,875 |

| Total liabilities and stockholders’ equity | $ 530,969 | $ 527,854 |

| CEO | Mr. Andrew R. Jassy |

|---|---|

| WEBSITE | aboutamazon.com |

| INDUSTRY | Internet Retail |

| EMPLOYEES | 65535 |