Market Summary

GOOG Stock Price

GOOG RSI Chart

GOOG Valuation

GOOG Price/Sales (Trailing)

GOOG Profitability

GOOG Fundamentals

GOOG Revenue

GOOG Earnings

Breaking Down GOOG Revenue

Last 7 days

6.7%

Last 30 days

8.1%

Last 90 days

17.4%

Trailing 12 Months

58.7%

How does GOOG drawdown profile look like?

GOOG Financial Health

GOOG Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 318.1B | 0 | 0 | 0 |

| 2023 | 284.6B | 289.5B | 297.1B | 307.4B |

| 2022 | 270.3B | 278.1B | 282.1B | 282.8B |

| 2021 | 196.7B | 220.3B | 239.2B | 257.6B |

| 2020 | 166.7B | 166.0B | 171.7B | 182.5B |

| 2019 | 142.0B | 148.3B | 155.1B | 161.9B |

| 2018 | 117.3B | 123.9B | 129.9B | 136.8B |

| 2017 | 94.8B | 99.3B | 104.6B | 110.9B |

| 2016 | 78.0B | 81.8B | 85.5B | 90.3B |

| 2015 | 68.2B | 70.5B | 72.7B | 75.0B |

| 2014 | 0 | 0 | 60.8B | 66.0B |

| 2013 | 0 | 0 | 0 | 55.5B |

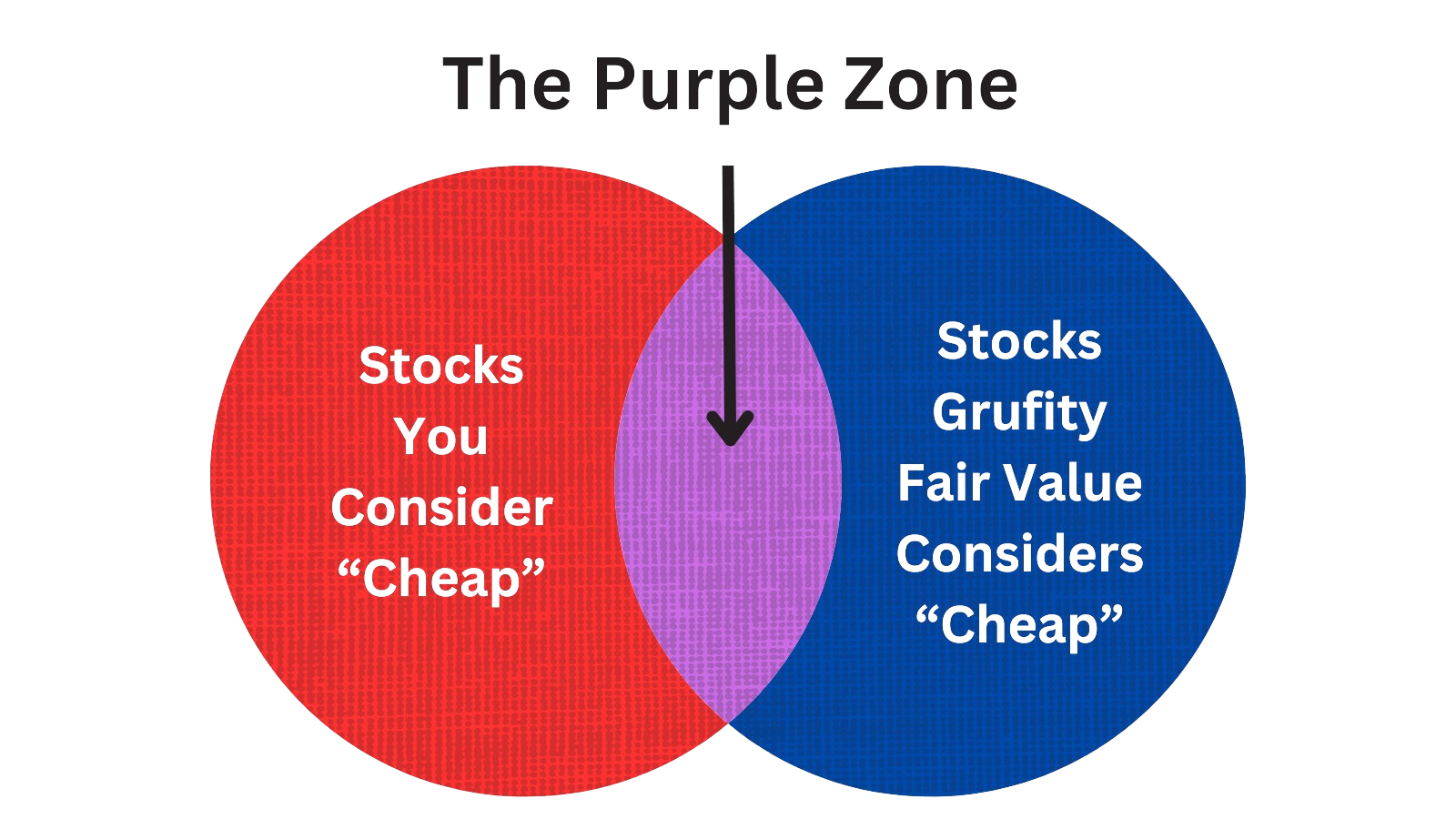

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of Alphabet Inc

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| May 01, 2024 | pichai sundar | sold | -3,753,100 | 166 | -22,500 | chief executive officer |

| Apr 30, 2024 | arnold frances | sold | -13,390 | 167 | -80.00 | - |

| Apr 26, 2024 | hennessy john l | sold | -369,096 | 175 | -2,100 | - |

| Apr 25, 2024 | o'toole amie thuener | sold (taxes) | -224,090 | 161 | -1,391 | vp, chief accounting officer |

| Apr 25, 2024 | o'toole amie thuener | sold | - | - | -1,364 | vp, chief accounting officer |

| Apr 25, 2024 | o'toole amie thuener | acquired | - | - | 1,364 | vp, chief accounting officer |

| Apr 17, 2024 | pichai sundar | sold | -3,541,760 | 157 | -22,500 | chief executive officer |

| Apr 12, 2024 | hennessy john l | sold | -127,648 | 159 | -800 | - |

| Apr 03, 2024 | pichai sundar | sold | -3,502,640 | 155 | -22,500 | chief executive officer |

Which funds bought or sold GOOG recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 01, 2024 | SMITH SHELLNUT WILSON LLC /ADV | unchanged | - | 28,437 | 381,853 | 0.20% |

| May 01, 2024 | SMITH SHELLNUT WILSON LLC /ADV | unchanged | - | 113,980 | 1,531,740 | 0.81% |

| May 01, 2024 | MCKINLEY CAPITAL MANAGEMENT LLC | reduced | -3.34 | 894,721 | 21,093,800 | 2.53% |

| May 01, 2024 | StoneX Group Inc. | added | 8.39 | 451,000 | 3,087,000 | 0.34% |

| May 01, 2024 | StoneX Group Inc. | reduced | -1.85 | 241,000 | 4,218,000 | 0.46% |

| May 01, 2024 | BANK HAPOALIM BM | reduced | -4.78 | 34,000 | 1,220,000 | 0.16% |

| May 01, 2024 | BANK HAPOALIM BM | reduced | -0.87 | 712,000 | 10,729,000 | 1.39% |

| May 01, 2024 | PDS Planning, Inc | added | 2.58 | 416,159 | 4,256,380 | 0.45% |

| May 01, 2024 | PDS Planning, Inc | added | 2.34 | 418,074 | 4,375,950 | 0.46% |

| May 01, 2024 | CREATIVE FINANCIAL DESIGNS INC /ADV | added | 0.84 | 96,407 | 1,174,380 | 0.11% |

Are Funds Buying or Selling GOOG?

Unveiling Alphabet Inc's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 14, 2024 | schmidt eric e | 1.03% | 60,994,606 | SC 13G/A | |

| Feb 13, 2024 | vanguard group inc | 7.18% | 410,957,639 | SC 13G/A | |

| Feb 13, 2024 | vanguard group inc | 8.34% | 493,782,758 | SC 13G/A | |

| Feb 12, 2024 | blackrock inc. | 6.2% | 356,934,964 | SC 13G/A | |

| Feb 12, 2024 | sergey brin | 6.16% | 363,474,028 | SC 13G/A | |

| Feb 01, 2024 | blackrock inc. | 7.0% | 415,076,460 | SC 13G/A | |

| Feb 14, 2023 | schmidt eric e | 1.13% | 67,895,332 | SC 13G/A | |

| Feb 14, 2023 | page lawrence | 6.12% | 389,051,160 | SC 13G/A | |

| Feb 13, 2023 | sergey brin | 5.82% | 368,712,520 | SC 13G/A | |

| Feb 09, 2023 | vanguard group inc | 6.94% | 422,660,991 | SC 13G/A |

Recent SEC filings of Alphabet Inc

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 02, 2024 | PX14A6G | PX14A6G | |

| May 01, 2024 | PX14A6G | PX14A6G | |

| May 01, 2024 | 4 | Insider Trading | |

| May 01, 2024 | 144 | Notice of Insider Sale Intent | |

| May 01, 2024 | 144 | Notice of Insider Sale Intent | |

| Apr 30, 2024 | 4 | Insider Trading | |

| Apr 30, 2024 | 144 | Notice of Insider Sale Intent | |

| Apr 26, 2024 | DEFA14A | DEFA14A | |

| Apr 26, 2024 | DEF 14A | DEF 14A | |

| Apr 26, 2024 | ARS | ARS |

- …

Peers (Alternatives to Alphabet Inc)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

GOOG | 2.1T | 318.1B | 8.08% | 58.74% | 25.31 | 6.56 | 11.78% | 40.66% |

META | 1.1T | 142.7B | -11.20% | 86.34% | 24.57 | 7.88 | 21.62% | 113.38% |

DASH | 46.4B | 9.1B | -16.87% | 83.31% | -110.36 | 5.09 | 27.24% | 69.09% |

SNAP | 27.6B | 4.8B | 47.11% | 101.98% | -21.23 | 5.73 | 6.28% | 7.14% |

| MID-CAP | ||||||||

MTCH | 8.4B | 3.4B | -11.16% | -6.79% | 12.87 | 2.49 | 5.51% | 81.01% |

YELP | 2.7B | 1.3B | 0.23% | 44.95% | 27.55 | 2.04 | 12.03% | 172.85% |

| SMALL-CAP | ||||||||

GETY | 1.5B | 916.6M | -6.17% | - | 78.78 | 1.68 | -1.05% | 125.21% |

EVER | 657.9M | 287.9M | 16.19% | 223.27% | -12.83 | 2.29 | -28.75% | -110.05% |

GRPN | 439.6M | 514.9M | -3.18% | 237.72% | -7.93 | 0.85 | -14.05% | 76.68% |

SCOR | 65.6M | 371.3M | -10.33% | -24.18% | -0.83 | 0.18 | -1.35% | -19.23% |

IZEA | 50.4M | 36.2M | 26.78% | 29.49% | -6.86 | 1.39 | -11.88% | -64.43% |

DGLY | 6.7M | 28.2M | 2.13% | -26.61% | -0.23 | 0.24 | -23.67% | -236.48% |

Alphabet Inc News

Alphabet Inc Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | -6.7% | 80,539 | 86,310 | 76,693 | 74,604 | 69,787 | 76,048 | 69,092 | 69,685 | 68,011 | 75,325 | 65,118 | 61,880 | 55,314 | 56,898 | 46,173 | 38,297 | 41,159 | 46,075 | 40,499 | 38,944 | 36,339 |

| Cost Of Revenue | -10.3% | 33,712 | 37,575 | 33,229 | 31,916 | 30,612 | 35,342 | 31,158 | 30,104 | 29,599 | 32,988 | 27,621 | 26,227 | 24,103 | 26,080 | 21,117 | 18,553 | 18,982 | 21,020 | 17,568 | 17,296 | 16,012 |

| Costs and Expenses | -12.1% | 55,067 | 62,613 | 55,350 | 52,766 | 52,372 | 57,888 | 51,957 | 50,232 | 47,917 | 53,440 | 44,087 | 42,519 | 38,877 | 41,247 | 34,960 | 31,914 | 33,182 | 36,809 | 31,322 | 29,764 | 29,731 |

| S&GA Expenses | -16.8% | 6,426 | 7,719 | 6,884 | 6,781 | 6,533 | 7,183 | 6,929 | 6,630 | 5,825 | 7,604 | 5,516 | 5,276 | 4,516 | 5,314 | 4,231 | 3,901 | 4,500 | 5,738 | 4,609 | 4,212 | 3,905 |

| R&D Expenses | -1.7% | 11,903 | 12,113 | 11,258 | 10,588 | 11,468 | 10,267 | 10,273 | 9,841 | 9,119 | 8,708 | 7,694 | 7,675 | 7,485 | 7,022 | 6,856 | 6,875 | 6,820 | 7,222 | 6,554 | 6,213 | 6,029 |

| EBITDA Margin | 6.6% | 0.34* | 0.32* | 0.31* | 0.30* | 0.30* | 0.30* | 0.32* | 0.35* | 0.37* | 0.39* | - | - | - | - | - | - | - | - | - | - | - |

| Interest Expenses | 36.2% | 94.00 | 69.00 | 116 | 43.00 | 80.00 | 90.00 | 101 | 83.00 | 83.00 | 117 | 77.00 | 76.00 | 76.00 | 53.00 | 48.00 | 13.00 | 21.00 | 17.00 | 23.00 | 25.00 | 35.00 |

| Income Taxes | 24.9% | 4,653 | 3,725 | 1,508 | 3,535 | 3,154 | 3,523 | 2,323 | 3,012 | 2,498 | 3,760 | 4,128 | 3,460 | 3,353 | 3,462 | 2,112 | 1,318 | 921 | 33.00 | 1,560 | 2,200 | 1,489 |

| Earnings Before Taxes | 16.0% | 28,315 | 24,412 | 21,197 | 21,903 | 18,205 | 17,147 | 16,233 | 19,014 | 18,934 | 24,402 | 23,064 | 21,985 | 21,283 | 18,689 | 13,359 | 8,277 | 7,757 | 10,704 | 8,628 | 12,147 | 8,146 |

| EBT Margin | 8.0% | 0.30* | 0.28* | 0.26* | 0.25* | 0.25* | 0.25* | 0.28* | 0.31* | 0.33* | 0.35* | 0.36* | 0.34* | 0.31* | 0.26* | 0.23* | 0.21* | 0.24* | 0.24* | 0.25* | 0.27* | 0.23* |

| Net Income | 14.4% | 23,662 | 20,687 | 19,689 | 18,368 | 15,051 | 13,624 | 13,910 | 16,002 | 16,436 | 20,642 | 18,936 | 18,525 | 17,930 | 15,227 | 11,247 | 6,959 | 6,836 | 10,671 | 7,068 | 9,947 | 6,657 |

| Net Income Margin | 7.9% | 0.26* | 0.24* | 0.22* | 0.21* | 0.21* | 0.21* | 0.24* | 0.26* | 0.28* | 0.30* | 0.30* | 0.29* | 0.26* | 0.22* | 0.21* | 0.19* | 0.21* | 0.21* | 0.21* | 0.23* | 0.20* |

| Free Cashflow | 113.2% | 16,836 | 7,896 | 22,601 | 21,778 | 17,220 | 16,019 | 16,077 | 12,594 | 15,320 | 18,551 | 18,720 | 16,394 | 13,347 | 17,198 | 11,597 | 8,602 | 5,446 | 8,375 | 8,734 | 6,501 | 7,362 |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | 1.2% | 407,350 | 402,392 | 396,711 | 383,044 | 369,491 | 365,264 | 358,255 | 355,185 | 357,096 | 359,268 | 347,403 | 335,387 | 327,095 | 319,616 | 299,243 | 278,492 | 273,403 | 275,909 | 263,044 | 257,101 | 245,349 |

| Current Assets | -3.5% | 165,471 | 171,530 | 176,310 | 168,788 | 161,985 | 164,795 | 166,109 | 172,371 | 177,853 | 188,143 | 184,110 | 175,697 | 172,137 | 174,296 | 164,369 | 149,069 | 147,018 | 152,578 | 148,358 | 147,437 | 138,207 |

| Cash Equivalents | 1.9% | 24,493 | 24,048 | 30,702 | 25,929 | 25,924 | 21,879 | 21,984 | 17,936 | 20,886 | 20,945 | 23,719 | 23,630 | 26,622 | 26,465 | 20,129 | 17,742 | 19,644 | 18,498 | 16,032 | 16,587 | 19,148 |

| Inventory | - | - | - | 2,957 | 2,231 | 2,315 | 2,670 | 3,156 | 1,980 | 1,369 | 1,170 | 1,278 | 907 | 888 | 728 | 835 | 815 | 889 | 999 | 1,401 | 964 | 1,053 |

| Net PPE | 6.6% | 143,182 | 134,345 | - | - | - | 112,668 | - | - | - | 97,599 | - | - | - | 84,749 | - | - | - | 73,646 | 69,252 | 64,891 | 60,528 |

| Goodwill | -0.1% | 29,183 | 29,198 | 29,146 | 29,210 | 28,994 | 28,960 | 28,834 | 23,949 | 23,010 | 22,956 | 22,623 | 22,406 | 22,341 | 21,175 | 20,870 | 20,824 | 20,734 | 20,624 | 18,069 | 18,000 | 17,943 |

| Liabilities | -3.8% | 114,506 | 119,013 | 123,509 | 115,903 | 108,597 | 109,120 | 104,629 | 99,766 | 103,092 | 107,633 | 102,836 | 97,822 | 97,082 | 97,072 | 86,323 | 71,170 | 69,744 | 74,467 | 68,075 | 64,909 | 61,877 |

| Current Liabilities | -5.9% | 76,997 | 81,814 | 86,295 | 77,709 | 68,854 | 69,300 | 65,979 | 61,354 | 61,948 | 64,254 | 61,782 | 55,741 | 55,453 | 56,834 | 48,200 | 43,658 | 40,189 | 45,221 | 39,224 | 37,000 | 34,910 |

| Long Term Debt | -0.2% | 13,228 | 13,253 | 13,781 | 13,705 | 13,697 | 14,701 | 14,653 | 14,734 | 14,791 | 14,817 | 14,288 | 14,328 | 13,887 | 13,932 | 13,902 | 4,018 | 5,016 | 4,554 | 4,082 | 4,074 | 4,066 |

| Shareholder's Equity | 3.3% | 292,844 | 283,379 | 273,202 | 267,141 | 260,894 | 256,144 | 253,626 | 255,419 | 254,004 | 251,635 | 244,567 | 237,565 | 230,013 | 222,544 | 212,920 | 207,322 | 203,659 | 201,442 | 194,969 | 192,192 | 183,472 |

| Retained Earnings | 4.0% | 219,770 | 211,247 | 205,647 | 200,884 | 196,625 | 195,563 | 196,220 | 196,845 | 195,221 | 191,484 | 183,782 | 176,939 | 170,580 | 163,401 | 155,567 | 151,681 | 151,068 | 152,122 | 147,125 | 145,346 | 138,720 |

| Accumulated Depreciation | 3.8% | 70,004 | 67,458 | - | - | - | 59,042 | - | - | - | 49,414 | - | - | - | 41,713 | - | - | - | 30,561 | 28,153 | 26,539 | 24,730 |

| Shares Outstanding | -0.6% | 12,381 | 12,460 | 12,541 | 12,629 | 12,722 | 12,849 | 12,971 | 13,078 | 13,175 | 13,242 | 13,294 | 13,353 | 13,422 | 13,504 | 13,554 | 13,624 | 13,679 | 13,767 | 13,818 | 13,881 | 13,896 |

| Float | - | - | - | - | 1,331,200 | - | - | - | 1,256,100 | - | - | - | 1,451,100 | - | - | - | 849,700 | - | - | - | 663,000 | - |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | 52.5% | 28,848 | 18,915 | 30,656 | 28,666 | 23,509 | 23,614 | 23,353 | 19,422 | 25,106 | 24,934 | 25,539 | 21,890 | 19,289 | 22,677 | 17,003 | 13,993 | 11,451 | 14,427 | 15,466 | 12,627 | 12,000 |

| Share Based Compensation | -7.0% | 5,264 | 5,659 | 5,743 | 5,774 | 5,284 | 5,100 | 4,976 | 4,782 | 4,504 | 3,954 | 3,874 | 3,803 | 3,745 | 3,223 | 3,195 | 3,382 | 3,191 | 2,645 | 2,624 | 2,756 | 2,769 |

| Cashflow From Investing | -38.9% | -8,564 | -6,167 | -7,150 | -10,800 | -2,946 | -6,227 | -833 | -4,187 | -9,051 | -11,016 | -10,050 | -9,074 | -5,383 | -7,281 | -15,197 | -8,448 | -1,847 | -4,703 | -8,945 | -10,455 | -5,388 |

| Cashflow From Financing | -2.1% | -19,714 | -19,308 | -18,382 | -17,835 | -16,568 | -17,629 | -18,097 | -17,817 | -16,214 | -16,511 | -15,254 | -15,991 | -13,606 | -9,270 | 546 | -7,498 | -8,186 | -7,326 | -6,954 | -4,746 | -4,183 |

| Buy Backs | 0.0% | 16,057 | 16,053 | 15,918 | 15,114 | 14,557 | 15,407 | 15,392 | 15,197 | 13,300 | 13,473 | 12,610 | 12,796 | 11,395 | 7,904 | 7,897 | 6,852 | 8,496 | 6,098 | 5,696 | 3,577 | 3,025 |

GOOG Income Statement

2024-03-31CONSOLIDATED STATEMENTS OF INCOME - USD ($) $ in Millions | 3 Months Ended | |

|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | |

| Income Statement [Abstract] | ||

| Revenues | $ 80,539 | $ 69,787 |

| Costs and expenses: | ||

| Cost of revenues | 33,712 | 30,612 |

| Research and development | 11,903 | 11,468 |

| Sales and marketing | 6,426 | 6,533 |

| General and administrative | 3,026 | 3,759 |

| Total costs and expenses | 55,067 | 52,372 |

| Income from operations | 25,472 | 17,415 |

| Other income (expense), net | 2,843 | 790 |

| Income before income taxes | 28,315 | 18,205 |

| Provision for income taxes | 4,653 | 3,154 |

| Net income | $ 23,662 | $ 15,051 |

| Basic net income per share of Class A, Class B, and Class C stock (in dollars per share) | $ 1.91 | $ 1.18 |

| Diluted net income per share of Class A, Class B, and Class C stock (in dollars per share) | $ 1.89 | $ 1.17 |

GOOG Balance Sheet

2024-03-31CONSOLIDATED BALANCE SHEETS - USD ($) $ in Millions | Mar. 31, 2024 | Dec. 31, 2023 |

|---|---|---|

| Current assets: | ||

| Cash and cash equivalents | $ 24,493 | $ 24,048 |

| Marketable securities | 83,597 | 86,868 |

| Total cash, cash equivalents, and marketable securities | 108,090 | 110,916 |

| Accounts receivable, net | 44,552 | 47,964 |

| Other current assets | 12,829 | 12,650 |

| Total current assets | 165,471 | 171,530 |

| Non-marketable securities | 33,994 | 31,008 |

| Deferred income taxes | 11,687 | 12,169 |

| Property and equipment, net | 143,182 | 134,345 |

| Operating lease assets | 13,768 | 14,091 |

| Goodwill | 29,183 | 29,198 |

| Other non-current assets | 10,065 | 10,051 |

| Total assets | 407,350 | 402,392 |

| Current liabilities: | ||

| Accounts payable | 6,198 | 7,493 |

| Accrued compensation and benefits | 9,703 | 15,140 |

| Accrued expenses and other current liabilities | 48,603 | 46,168 |

| Accrued revenue share | 8,520 | 8,876 |

| Deferred revenue | 3,973 | 4,137 |

| Total current liabilities | 76,997 | 81,814 |

| Long-term debt | 13,228 | 13,253 |

| Deferred revenue, non-current | 921 | 911 |

| Income taxes payable, non-current | 9,234 | 8,474 |

| Deferred income taxes | 486 | 485 |

| Operating lease liabilities | 11,957 | 12,460 |

| Other long-term liabilities | 1,683 | 1,616 |

| Total liabilities | 114,506 | 119,013 |

| Commitments and Contingencies (Note 8) | ||

| Stockholders’ equity: | ||

| Preferred stock, $0.001 par value per share, 100 shares authorized; no shares issued and outstanding | 0 | 0 |

| Class A, Class B, and Class C stock and additional paid-in capital, $0.001 par value per share: 300,000 shares authorized (Class A 180,000, Class B 60,000, Class C 60,000); 12,460 (Class A 5,899, Class B 870, Class C 5,691) and 12,381 (Class A 5,879, Class B 867, Class C 5,635) shares issued and outstanding | 77,913 | 76,534 |

| Accumulated other comprehensive income (loss) | (4,839) | (4,402) |

| Retained earnings | 219,770 | 211,247 |

| Total stockholders’ equity | 292,844 | 283,379 |

| Total liabilities and stockholders’ equity | $ 407,350 | $ 402,392 |

| CEO | Mr. Sundar Pichai |

|---|---|

| WEBSITE | abc.xyz |

| INDUSTRY | Internet Retail |

| EMPLOYEES | 65535 |