Market Summary

HPQ Stock Price

HPQ RSI Chart

HPQ Valuation

HPQ Price/Sales (Trailing)

HPQ Profitability

HPQ Fundamentals

HPQ Revenue

HPQ Earnings

Breaking Down HPQ Revenue

Last 7 days

-3.7%

Last 30 days

6.7%

Last 90 days

15.9%

Trailing 12 Months

15.5%

How does HPQ drawdown profile look like?

HPQ Financial Health

HPQ Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 53.1B | 53.0B | 0 | 0 |

| 2023 | 59.7B | 56.1B | 54.7B | 53.7B |

| 2022 | 64.8B | 65.4B | 64.8B | 62.9B |

| 2021 | 57.7B | 61.1B | 62.1B | 63.5B |

| 2020 | 58.7B | 57.1B | 56.8B | 56.6B |

| 2019 | 58.7B | 58.7B | 58.7B | 58.8B |

| 2018 | 53.9B | 55.5B | 57.0B | 58.5B |

| 2017 | 48.7B | 49.5B | 50.6B | 52.1B |

| 2016 | 49.9B | 48.5B | 48.0B | 48.2B |

| 2015 | 55.4B | 54.1B | 52.8B | 51.5B |

| 2014 | 55.6B | 56.0B | 56.3B | 56.7B |

| 2013 | 118.7B | 115.6B | 113.1B | 55.3B |

| 2012 | 125.0B | 124.0B | 122.5B | 120.4B |

| 2011 | 127.2B | 127.9B | 128.4B | 127.2B |

| 2010 | 116.9B | 120.4B | 123.5B | 126.0B |

| 2009 | 117.4B | 116.5B | 115.5B | 114.6B |

| 2008 | 0 | 0 | 111.3B | 118.4B |

| 2007 | 0 | 0 | 0 | 104.3B |

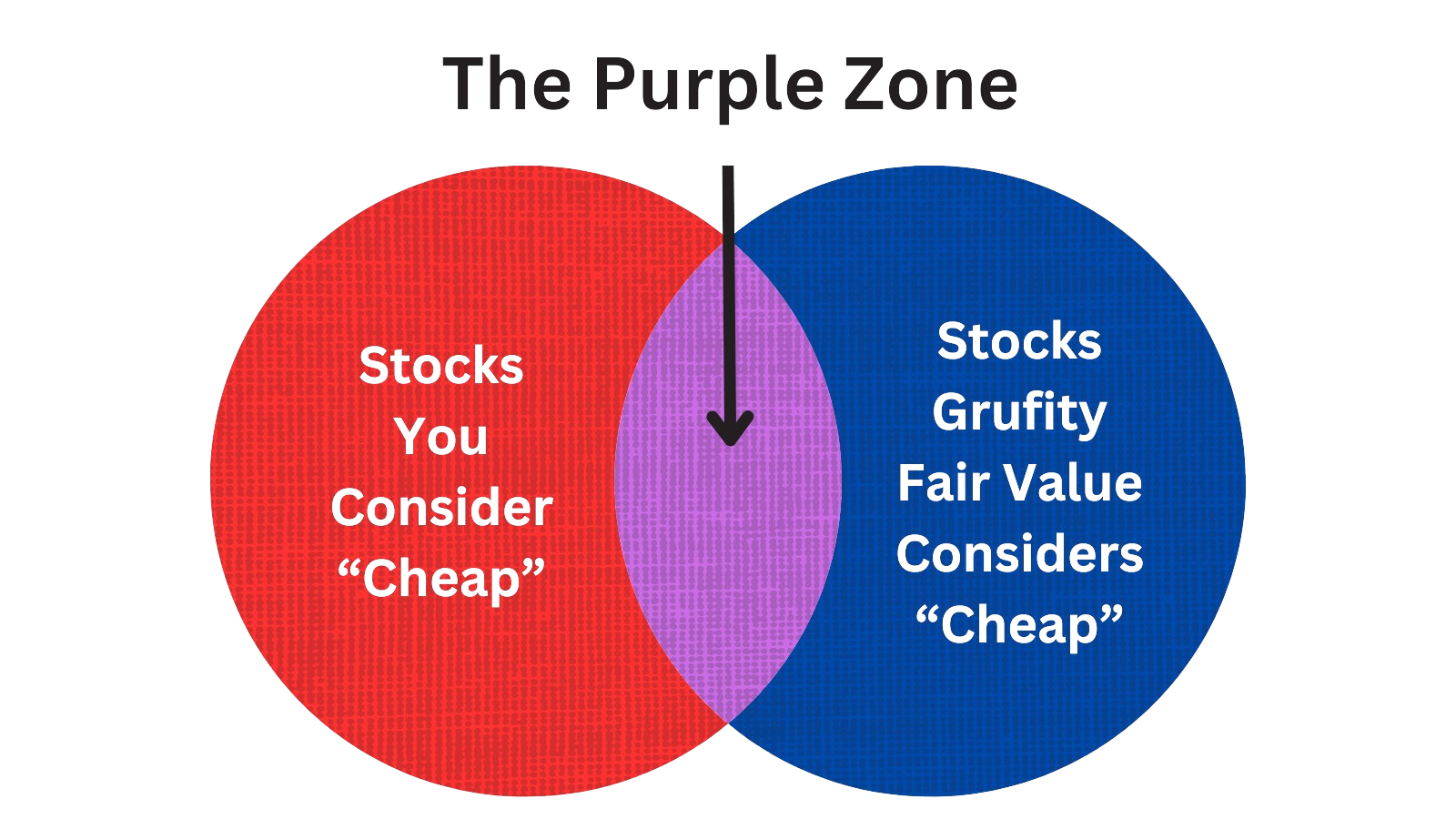

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of HP Inc

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| Jun 21, 2024 | cho alex | acquired | 4,099,880 | 23.68 | 173,137 | president, personal systems |

| Jun 21, 2024 | cho alex | sold | -6,251,980 | 36.11 | -173,137 | president, personal systems |

| Jun 17, 2024 | francisco ma. fatima | acquired | - | - | 4,312 | - |

| Apr 22, 2024 | broussard bruce d | acquired | 105,011 | 8.94927 | 11,734 | - |

| Apr 22, 2024 | alvarez aida | acquired | - | - | 7,943 | - |

| Apr 22, 2024 | meline david w | acquired | - | - | 7,943 | - |

| Apr 22, 2024 | miscik judith a | acquired | - | - | 7,943 | - |

| Apr 01, 2024 | bergh charles v | acquired | - | - | 6,470 | - |

| Mar 21, 2024 | bennett robert r | sold | -2,010,670 | 30.01 | -67,000 | - |

| Mar 20, 2024 | lores enrique | gifted | - | - | -888,908 | president and ceo |

Which funds bought or sold HPQ recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| Jun 28, 2024 | Quent Capital, LLC | added | 3.61 | 8,393 | 214,897 | 0.03% |

| Jun 26, 2024 | Financial Gravity Asset Management, Inc. | reduced | -87.32 | -2,371,500 | 17,858 | -% |

| Jun 26, 2024 | Old Port Advisors | reduced | -1.97 | -4,345 | 277,087 | 0.09% |

| Jun 21, 2024 | Cape Investment Advisory, Inc. | unchanged | - | 29.00 | 6,890 | -% |

| Jun 21, 2024 | Abich Financial Wealth Management LLC | added | 66.64 | 50,002 | 124,234 | 0.10% |

| Jun 20, 2024 | HM PAYSON & CO | reduced | -45.65 | -26,470,700 | 31,815,800 | 0.59% |

| Jun 17, 2024 | TruNorth Capital Management, LLC | new | - | 4,110 | 4,110 | -% |

| Jun 13, 2024 | MOSAIC FAMILY WEALTH PARTNERS, LLC | reduced | -0.43 | 27.00 | 1,027,480 | 0.17% |

| Jun 11, 2024 | EverSource Wealth Advisors, LLC | reduced | -8.04 | -12,224 | 74,185 | 0.01% |

| Jun 07, 2024 | Railway Pension Investments Ltd | unchanged | - | 203,556 | 47,318,900 | 0.46% |

Are Funds Buying or Selling HPQ?

Unveiling HP Inc's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Mar 07, 2024 | blackrock inc. | 10.1% | 98,953,945 | SC 13G | |

| Feb 14, 2024 | berkshire hathaway inc | 2.3% | 22,852,715 | SC 13G/A | |

| Feb 13, 2024 | dodge & cox | 3.6% | 35,413,307 | SC 13G/A | |

| Feb 13, 2024 | vanguard group inc | 11.88% | 117,715,805 | SC 13G/A | |

| Jan 24, 2024 | blackrock inc. | 9.8% | 96,713,356 | SC 13G/A | |

| Dec 11, 2023 | berkshire hathaway inc | 5.2% | 51,503,537 | SC 13G/A | |

| Jul 10, 2023 | vanguard group inc | 10.61% | 104,625,445 | SC 13G/A | |

| Feb 14, 2023 | dodge & cox | 5.3% | 52,451,225 | SC 13G/A | |

| Feb 09, 2023 | vanguard group inc | 9.54% | 93,653,441 | SC 13G/A | |

| Feb 03, 2023 | state street corp | 4.86% | 47,702,021 | SC 13G/A |

Recent SEC filings of HP Inc

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| Jun 26, 2024 | 8-K | Current Report | |

| Jun 24, 2024 | 4 | Insider Trading | |

| Jun 21, 2024 | 144 | Notice of Insider Sale Intent | |

| Jun 18, 2024 | 3 | Insider Trading | |

| Jun 18, 2024 | 4 | Insider Trading | |

| Jun 17, 2024 | 8-K | Current Report | |

| Jun 06, 2024 | 11-K | Employee Benefit Details | |

| May 30, 2024 | 10-Q | Quarterly Report | |

| May 30, 2024 | S-8 | Employee Benefits Plan | |

| May 30, 2024 | SD | SD |

Peers (Alternatives to HP Inc)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

CSCO | 191.4B | 55.4B | 3.10% | -7.23% | 15.8 | 3.46 | 0.85% | 5.63% |

ANET | 109.8B | 6.1B | 13.66% | 119.99% | 47.99 | 18.06 | 25.22% | 50.89% |

HPQ | 34.2B | 53.0B | 6.74% | 15.47% | 11.53 | 0.65 | -5.57% | 13.23% |

HPE | 27.5B | 29.1B | 16.45% | 27.15% | 12.51 | 0.87 | 2.24% | 133.29% |

LOGI | 14.9B | 4.3B | 1.80% | 65.62% | 24.28 | 3.46 | -5.30% | 67.91% |

JNPR | 11.8B | 5.3B | 5.29% | 18.04% | 52.9 | 2.22 | -2.96% | -55.26% |

| MID-CAP | ||||||||

UI | 8.8B | 1.9B | 2.88% | -15.66% | 25.17 | 4.61 | 1.03% | -11.76% |

BDC | 3.8B | 2.4B | -0.49% | -1.77% | 17.59 | 1.59 | -8.79% | -23.10% |

LITE | 3.4B | 1.4B | 17.32% | -10.49% | -9.72 | 2.42 | -21.81% | -865.12% |

| SMALL-CAP | ||||||||

EXTR | 1.8B | 1.2B | 20.81% | -47.61% | -276.35 | 1.43 | -0.19% | -110.91% |

ADTN | 416.2M | 1.1B | -5.41% | -50.28% | -0.75 | 0.4 | -12.01% | -1246.95% |

AAOI | 323.3M | 205.3M | -30.63% | 53.04% | -5.14 | 1.57 | -8.19% | 5.55% |

ALOT | 115.7M | 145.6M | -13.34% | 6.95% | 23.02 | 0.79 | -0.89% | 63.00% |

AIRG | 65.2M | 53.8M | 16.80% | 13.72% | -5.42 | 1.21 | -28.06% | -33.67% |

AKTS | 12.8M | 29.9M | -31.58% | -95.81% | -0.17 | 0.43 | 39.86% | -24.01% |

HP Inc News

HP Inc Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q2 | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 |

| Revenue | -2.9% | 12,800 | 13,185 | 13,817 | 13,196 | 12,907 | 13,798 | 14,774 | 14,648 | 16,475 | 17,013 | 16,648 | 15,289 | 15,877 | 15,646 | 15,257 | 14,294 | 12,469 | 14,618 | 15,407 | 14,603 | 14,036 |

| Cost Of Revenue | -5.1% | 9,777 | 10,297 | 10,832 | 10,374 | 9,993 | 11,011 | 12,083 | 11,764 | 13,178 | 13,622 | 13,393 | 11,901 | 12,437 | 12,322 | 12,594 | 11,901 | 9,976 | 11,746 | 12,483 | 11,698 | 11,307 |

| Gross Profit | 4.7% | 3,023 | 2,888 | - | - | 2,914 | 2,787 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - |

| Costs and Expenses | 6.0% | 2,071 | 1,953 | 23,305 | 12,244 | 2,167 | 2,044 | 14,033 | 13,392 | 15,218 | 15,708 | 15,353 | 13,908 | 14,515 | 14,325 | 14,285 | 13,515 | 11,643 | 13,753 | 14,463 | 13,524 | 13,108 |

| S&GA Expenses | 5.7% | 1,462 | 1,383 | 1,327 | 1,302 | 1,397 | 1,331 | 1,189 | 1,143 | 1,464 | 1,468 | 1,460 | 1,408 | 1,483 | 1,376 | 1,239 | 1,156 | 1,216 | 1,290 | 1,405 | 1,376 | 1,339 |

| R&D Expenses | 9.3% | 436 | 399 | 411 | 354 | 410 | 403 | 382 | 368 | 425 | 478 | 386 | 477 | 514 | 471 | 380 | 359 | 338 | 400 | 389 | 413 | 353 |

| EBITDA Margin | 5.4% | 0.08* | 0.08* | 0.08* | 0.07* | 0.07* | 0.08* | 0.09* | 0.13* | 0.13* | 0.13* | 0.14* | 0.09* | 0.08* | 0.08* | 0.07* | 0.07* | 0.06* | 0.06* | 0.06* | 0.07* | - |

| Income Taxes | 11.1% | 190 | 171 | -122 | 170 | -467 | 93.00 | 670 | 64.00 | 235 | 223 | 473 | 218 | 108 | 228 | 117 | 17.00 | 62.00 | 200 | 104 | -931 | 101 |

| Earnings Before Taxes | 0.5% | 797 | 793 | 852 | 936 | 587 | 562 | 647 | 1,186 | 1,216 | 1,275 | 3,610 | 1,326 | 1,336 | 1,296 | 756 | 751 | 826 | 878 | 492 | 248 | 883 |

| EBT Margin | 6.8% | 0.06* | 0.06* | 0.05* | 0.05* | 0.05* | 0.06* | 0.07* | 0.11* | 0.11* | 0.12* | 0.12* | 0.08* | 0.07* | 0.06* | 0.06* | 0.05* | 0.04* | 0.04* | 0.04* | 0.05* | - |

| Net Income | -2.4% | 607 | 622 | 974 | 766 | 1,054 | 469 | -23.00 | 1,122 | 981 | 1,052 | 3,137 | 1,108 | 1,228 | 1,068 | 639 | 734 | 764 | 678 | 388 | 1,179 | 782 |

| Net Income Margin | -12.9% | 0.06* | 0.06* | 0.06* | 0.04* | 0.05* | 0.04* | 0.05* | 0.10* | 0.10* | 0.10* | 0.10* | 0.07* | 0.06* | 0.06* | 0.05* | 0.05* | 0.05* | 0.05* | 0.05* | 0.07* | - |

| Free Cashflow | 380.2% | 581 | 121 | 1,975 | 976 | 636 | -16.00 | 1,904 | 394 | 508 | 1,657 | 2,848 | 1,093 | 1,446 | 1,022 | 1,874 | 1,667 | -510 | 1,285 | 588 | 2,343 | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q2 | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 |

| Assets | 4.4% | 37,433 | 35,846 | 37,004 | 36,632 | 36,366 | 36,148 | 38,494 | 39,247 | 39,901 | 38,912 | 38,605 | 35,523 | 34,549 | 34,737 | 34,681 | 34,244 | 33,773 | 31,656 | 33,467 | 32,405 | 31,946 |

| Current Assets | 10.3% | 18,593 | 16,858 | 17,977 | 17,463 | 17,023 | 17,305 | 19,736 | 22,996 | 23,515 | 22,432 | 22,168 | 20,603 | 20,091 | 20,438 | 20,648 | 20,269 | 19,660 | 17,477 | 20,177 | 19,683 | 18,285 |

| Cash Equivalents | 4.1% | 2,517 | 2,417 | 3,232 | 1,718 | 1,940 | 1,769 | 3,145 | 5,386 | 4,477 | 3,394 | 4,299 | 3,439 | 3,424 | 4,160 | 4,864 | 4,679 | 4,054 | 4,205 | 4,537 | 4,919 | 3,556 |

| Inventory | 8.4% | 7,512 | 6,928 | 6,862 | 7,197 | 7,221 | 7,344 | 7,614 | 8,192 | 8,944 | 9,018 | 7,930 | 8,165 | 7,502 | 6,668 | 5,963 | 5,896 | 6,354 | 4,946 | 5,734 | 5,716 | 5,394 |

| Net PPE | -0.5% | 2,794 | 2,807 | 2,827 | 2,783 | 2,771 | 2,764 | 2,774 | 2,626 | 2,613 | 2,619 | 2,546 | 2,500 | 2,538 | 2,546 | 2,627 | 2,658 | 2,714 | 2,756 | 2,794 | 2,462 | 2,412 |

| Goodwill | -0.2% | 8,590 | 8,610 | 8,591 | 8,614 | 8,618 | 8,592 | 8,541 | 6,809 | 6,801 | 6,821 | 6,803 | 6,628 | 6,524 | 6,404 | 6,380 | 6,386 | 6,370 | 6,387 | 6,372 | 6,330 | 6,349 |

| Current Liabilities | 4.1% | 24,839 | 23,857 | 24,488 | 25,190 | 24,034 | 25,053 | 26,189 | 26,809 | 28,906 | 30,199 | 29,061 | 27,667 | 28,029 | 27,880 | 26,220 | 25,026 | 25,276 | 23,867 | 25,293 | 24,579 | 23,203 |

| Long Term Debt | 0.3% | 9,327 | 9,301 | 9,254 | 9,236 | 10,360 | 10,337 | 10,796 | 10,294 | 8,304 | 6,368 | 6,386 | 6,898 | 4,917 | 4,939 | 5,543 | 5,981 | 3,941 | 3,932 | 4,780 | 4,730 | 4,749 |

| LT Debt, Non Current | 0.3% | 9,327 | 9,301 | 9,254 | 9,236 | 10,360 | 10,337 | 10,796 | - | - | - | 6,386 | - | - | - | 5,543 | - | - | - | - | - | - |

| Shareholder's Equity | 44.1% | -916 | -1,640 | -1,069 | - | -2,593 | -3,827 | -3,025 | - | - | - | - | - | - | - | - | - | - | - | - | - | - |

| Retained Earnings | 18.5% | -2,257 | -2,771 | -2,361 | -3,336 | -3,470 | -4,540 | -4,492 | -3,695 | -3,336 | -3,369 | -2,470 | -3,871 | -3,070 | -2,759 | -1,961 | -1,353 | -633 | -1,306 | -818 | -1,068 | -1,325 |

| Additional Paid-In Capital | 5.3% | 1,663 | 1,579 | 1,505 | 1,435 | 1,344 | 1,256 | 1,172 | 1,130 | 1,081 | 1,046 | 1,060 | 1,050 | 1,018 | 984 | 963 | 958 | 926 | 866 | 835 | 785 | 723 |

| Shares Outstanding | -0.2% | 978 | 980 | 989 | 988 | 991 | 989 | 980 | 1,024 | 1,050 | 1,081 | 1,208 | 1,185 | 1,260 | 1,285 | 1,413 | 1,417 | 1,444 | 1,454 | 1,515 | - | - |

| Float | - | - | - | - | - | 29,293 | - | - | - | 37,841 | - | - | - | 40,932 | - | - | - | 22,154 | - | - | - | 30,008 |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q2 | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 |

| Cashflow From Operations | 380.2% | 581 | 121 | 1,975 | 976 | 636 | -16.00 | 1,904 | 394 | 508 | 1,657 | 2,848 | 1,093 | 1,446 | 1,022 | 1,874 | 1,667 | -510 | 1,285 | 588 | 2,343 | 861 |

| Share Based Compensation | -46.9% | 94.00 | 177 | 85.00 | 91.00 | 95.00 | 167 | 70.00 | 70.00 | 70.00 | 133 | 70.00 | 69.00 | 76.00 | 115 | 57.00 | 49.00 | 63.00 | 109 | 64.00 | 60.00 | 66.00 |

| Cashflow From Investing | 78.5% | -49.00 | -228 | -20.00 | -129 | -6.00 | -435 | -2,876 | -211 | -182 | -280 | -400 | -297 | -312 | -3.00 | -85.00 | -551 | 118 | -498 | -227 | -189 | 296 |

| Cashflow From Financing | 39.0% | -432 | -708 | -441 | -1,069 | -459 | -925 | -1,269 | 726 | 757 | -2,282 | -1,588 | -781 | -1,870 | -1,723 | -1,604 | -491 | 241 | -1,119 | -743 | -791 | -968 |

| Dividend Payments | -2.2% | 269 | 275 | 260 | 259 | 259 | 259 | 249 | 255 | 262 | 271 | 219 | 230 | 239 | 250 | 238 | 251 | 252 | 256 | 236 | 240 | 245 |

| Buy Backs | -80.5% | 100 | 514 | - | - | - | 100 | 797 | 1,000 | 1,000 | 1,500 | 1,749 | 1,500 | 1,600 | 1,400 | 1,300 | 1,000 | 100 | 700 | 473 | 500 | 700 |

HPQ Income Statement

2024-04-30Consolidated Condensed Statements of Earnings (Unaudited) - USD ($) shares in Millions, $ in Millions | 3 Months Ended | 6 Months Ended | ||

|---|---|---|---|---|

Apr. 30, 2024 | Apr. 30, 2023 | Apr. 30, 2024 | Apr. 30, 2023 | |

| Net revenue: | ||||

| Total net revenue | $ 12,800 | $ 12,907 | $ 25,985 | $ 26,705 |

| Cost of net revenue: | ||||

| Total cost of net revenue | 9,777 | 9,993 | 20,074 | 21,004 |

| Gross margin | 3,023 | 2,914 | 5,911 | 5,701 |

| Research and development | 436 | 410 | 835 | 813 |

| Selling, general and administrative | 1,462 | 1,397 | 2,845 | 2,728 |

| Restructuring and other charges | 71 | 200 | 134 | 341 |

| Acquisition and divestiture charges | 22 | 74 | 49 | 158 |

| Amortization of intangible assets | 80 | 86 | 161 | 171 |

| Total operating expenses | 2,071 | 2,167 | 4,024 | 4,211 |

| Earnings from operations | 952 | 747 | 1,887 | 1,490 |

| Interest and other, net | (155) | (160) | (297) | (341) |

| Earnings before taxes | 797 | 587 | 1,590 | 1,149 |

| (Provision for) benefit from taxes | (190) | 467 | (361) | 374 |

| Net earnings | $ 607 | $ 1,054 | $ 1,229 | $ 1,523 |

| Net earnings per share: | ||||

| Basic (usd per share) | $ 0.62 | $ 1.06 | $ 1.24 | $ 1.54 |

| Diluted (usd per share) | $ 0.61 | $ 1.06 | $ 1.23 | $ 1.53 |

| Weighted-average shares used to compute net earnings per share: | ||||

| Basic (in shares) | 984 | 991 | 990 | 990 |

| Diluted (in shares) | 990 | 998 | 996 | 997 |

| Products | ||||

| Net revenue: | ||||

| Total net revenue | $ 12,043 | $ 12,149 | $ 24,462 | $ 25,193 |

| Cost of net revenue: | ||||

| Total cost of net revenue | 9,324 | 9,557 | 19,195 | 20,146 |

| Services | ||||

| Net revenue: | ||||

| Total net revenue | 757 | 758 | 1,523 | 1,512 |

| Cost of net revenue: | ||||

| Total cost of net revenue | $ 453 | $ 436 | $ 879 | $ 858 |

HPQ Balance Sheet

2024-04-30Consolidated Condensed Balance Sheets (Unaudited) - USD ($) $ in Millions | Apr. 30, 2024 | Oct. 31, 2023 |

|---|---|---|

| Current assets: | ||

| Cash, cash equivalents and restricted cash | $ 2,517 | $ 3,232 |

| Accounts receivable, net of allowance for credit losses of $84 and $93, respectively | 4,319 | 4,237 |

| Inventory | 7,512 | 6,862 |

| Other current assets | 4,245 | 3,646 |

| Total current assets | 18,593 | 17,977 |

| Property, plant and equipment, net | 2,794 | 2,827 |

| Goodwill | 8,590 | 8,591 |

| Other non-current assets | 7,456 | 7,609 |

| Total assets | 37,433 | 37,004 |

| Current liabilities: | ||

| Notes payable and short-term borrowings | 265 | 230 |

| Accounts payable | 14,362 | 14,046 |

| Other current liabilities | 10,212 | 10,212 |

| Total current liabilities | 24,839 | 24,488 |

| Long-term debt | 9,327 | 9,254 |

| Other non-current liabilities | 4,183 | 4,331 |

| Stockholders’ deficit: | ||

| Preferred stock, $0.01 par value (300 shares authorized; none issued) | 0 | 0 |

| Common stock, $0.01 par value (9,600 shares authorized; 978 and 989 shares issued and outstanding at April 30, 2024 and October 31, 2023, respectively) | 10 | 10 |

| Additional paid-in capital | 1,663 | 1,505 |

| Accumulated deficit | (2,257) | (2,361) |

| Accumulated other comprehensive loss | (332) | (223) |

| Total stockholders’ deficit | (916) | (1,069) |

| Total liabilities and stockholders’ deficit | $ 37,433 | $ 37,004 |

| CEO | Mr. Enrique J. Lores |

|---|---|

| WEBSITE | hp.com |

| INDUSTRY | Computer Hardware |

| EMPLOYEES | 58000 |