Market Summary

NXPI Alerts

NXPI Stock Price

NXPI RSI Chart

NXPI Valuation

NXPI Price/Sales (Trailing)

NXPI Profitability

NXPI Fundamentals

NXPI Revenue

NXPI Earnings

Breaking Down NXPI Revenue

Last 7 days

-0.7%

Last 30 days

-1.7%

Last 90 days

8.6%

Trailing 12 Months

34.7%

How does NXPI drawdown profile look like?

NXPI Financial Health

NXPI Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 13.3B | 0 | 0 | 0 |

| 2023 | 13.2B | 13.2B | 13.2B | 13.3B |

| 2022 | 11.6B | 12.3B | 12.9B | 13.2B |

| 2021 | 9.2B | 9.9B | 10.5B | 11.1B |

| 2020 | 8.8B | 8.4B | 8.4B | 8.6B |

| 2019 | 9.3B | 9.2B | 9.0B | 8.9B |

| 2018 | 9.3B | 9.3B | 9.4B | 9.4B |

| 2017 | 9.4B | 9.4B | 9.3B | 9.3B |

| 2016 | 7.0B | 7.8B | 8.6B | 9.5B |

| 2015 | 5.8B | 5.9B | 6.0B | 6.1B |

| 2014 | 5.0B | 5.2B | 5.4B | 5.6B |

| 2013 | 4.5B | 4.6B | 4.7B | 4.8B |

| 2012 | 4.2B | 4.3B | 4.3B | 4.4B |

| 2011 | 4.3B | 4.3B | 4.2B | 4.2B |

| 2010 | 0 | 0 | 0 | 4.4B |

| 2009 | 0 | 0 | 0 | 3.5B |

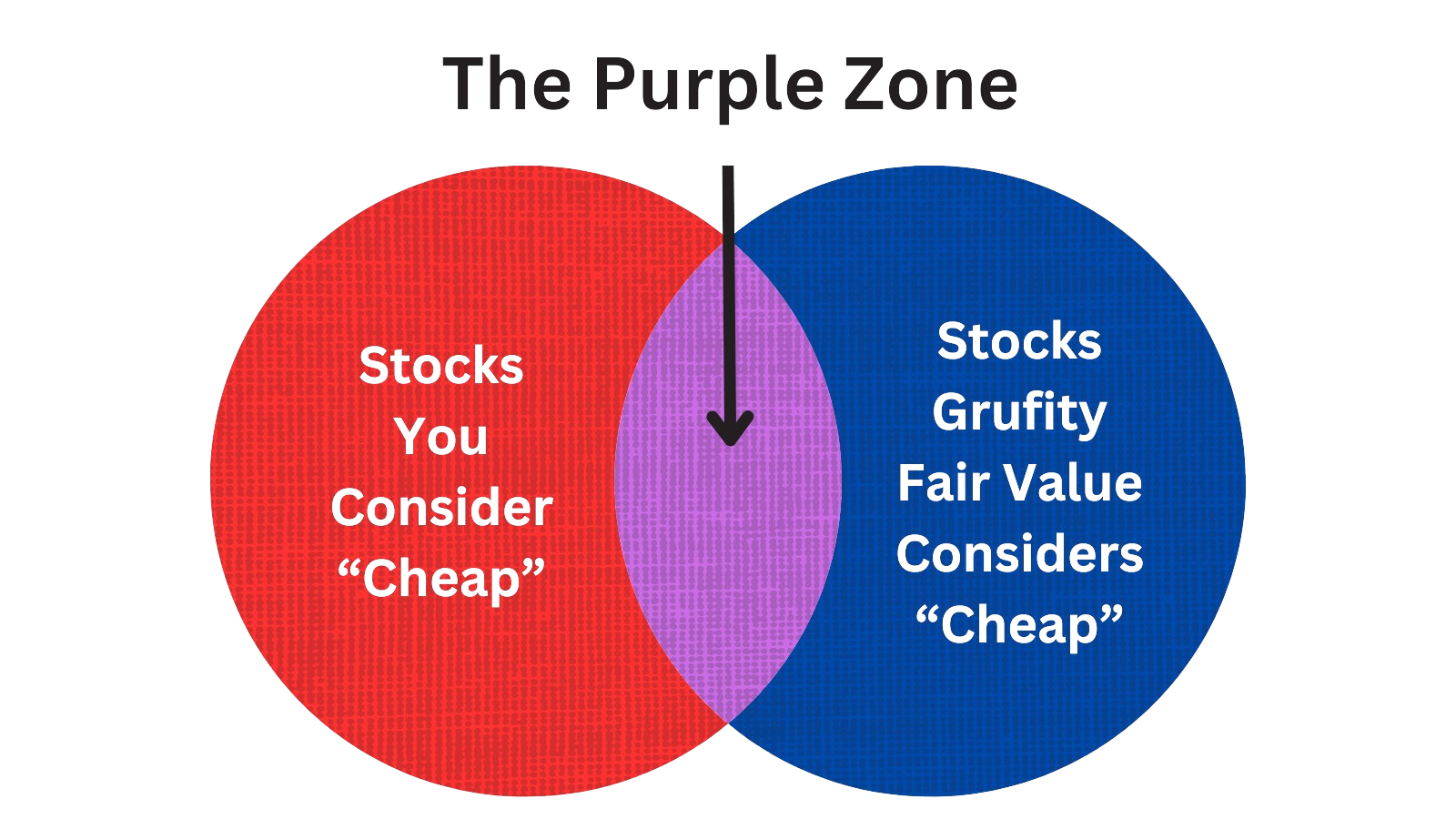

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of NXP Semiconductors NV

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| Jun 10, 2024 | sievers kurt | sold | -2,357,110 | 275 | -8,548 | ceo & president |

| May 29, 2024 | olving lena | acquired | - | - | 1,211 | - |

| May 29, 2024 | foxx anthony r | acquired | - | - | 1,211 | - |

| May 29, 2024 | staiblin jasmin | sold (taxes) | -117,445 | 279 | -420 | - |

| May 29, 2024 | clayton annette k | sold (taxes) | -117,445 | 279 | -420 | - |

| May 29, 2024 | sundstrom karl-henrik | acquired | - | - | 1,211 | - |

| May 29, 2024 | southern julie | acquired | - | - | 1,211 | - |

| May 29, 2024 | summe gregory l | acquired | - | - | 1,211 | - |

| May 29, 2024 | sundstrom karl-henrik | sold (taxes) | -167,778 | 279 | -600 | - |

| May 29, 2024 | summe gregory l | sold (taxes) | -167,778 | 279 | -600 | - |

Which funds bought or sold NXPI recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| Jun 28, 2024 | Quent Capital, LLC | unchanged | - | 7,743 | 106,046 | 0.01% |

| Jun 26, 2024 | Old Port Advisors | added | 5.4 | 31,470 | 261,150 | 0.08% |

| Jun 26, 2024 | Financial Gravity Asset Management, Inc. | added | 45.26 | 15,609 | 33,884 | -% |

| Jun 21, 2024 | Abich Financial Wealth Management LLC | sold off | -100 | -88,656 | - | -% |

| Jun 20, 2024 | HM PAYSON & CO | added | 13.54 | 11,450,100 | 62,378,700 | 1.16% |

| Jun 11, 2024 | EverSource Wealth Advisors, LLC | reduced | -3.07 | 26,021 | 347,349 | 0.03% |

| Jun 11, 2024 | Jackson Wealth Management, LLC | added | 9.23 | 344,000 | 2,269,000 | 0.28% |

| Jun 10, 2024 | Hamilton Wealth, LLC | sold off | -100 | -233,125 | - | -% |

| Jun 07, 2024 | Railway Pension Investments Ltd | unchanged | - | 367,227 | 5,029,730 | 0.05% |

| Jun 04, 2024 | DekaBank Deutsche Girozentrale | reduced | -17.51 | -3,584,000 | 30,136,000 | 0.06% |

Are Funds Buying or Selling NXPI?

NXPI Alerts

Unveiling NXP Semiconductors NV's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Mar 11, 2024 | fmr llc | - | 0 | SC 13G/A | |

| Feb 09, 2024 | fmr llc | - | 0 | SC 13G/A | |

| Feb 06, 2024 | blackrock inc. | 7.1% | 18,347,843 | SC 13G/A | |

| Jan 23, 2024 | jpmorgan chase & co | 10.1% | 26,200,067 | SC 13G/A | |

| Aug 10, 2023 | fmr llc | - | 0 | SC 13G/A | |

| Feb 13, 2023 | blackrock inc. | 7.0% | 18,070,515 | SC 13G/A | |

| Feb 09, 2023 | fmr llc | - | 0 | SC 13G/A | |

| Feb 09, 2023 | jpmorgan chase & co | 10.3% | 26,696,565 | SC 13G/A | |

| Jan 25, 2023 | jpmorgan chase & co | 9.9% | 25,848,870 | SC 13G/A | |

| Feb 14, 2022 | price t rowe associates inc /md/ | 2.3% | 6,266,352 | SC 13G/A |

Recent SEC filings of NXP Semiconductors NV

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| Jun 11, 2024 | 4 | Insider Trading | |

| Jun 10, 2024 | 144 | Notice of Insider Sale Intent | |

| Jun 05, 2024 | 8-K | Current Report | |

| May 31, 2024 | 4 | Insider Trading | |

| May 31, 2024 | 4 | Insider Trading | |

| May 31, 2024 | 4 | Insider Trading | |

| May 31, 2024 | 4 | Insider Trading | |

| May 31, 2024 | 4 | Insider Trading | |

| May 31, 2024 | 4 | Insider Trading | |

| May 31, 2024 | 4 | Insider Trading |

Peers (Alternatives to NXP Semiconductors NV)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

NVDA | 3.0T | 79.8B | 7.51% | 202.40% | 71.29 | 38.07 | 208.27% | 788.74% |

AMD | 262.2B | 22.8B | -1.77% | 45.82% | 234.93 | 11.5 | -1.16% | 182.53% |

AMAT | 195.9B | 26.5B | 7.76% | 63.66% | 26.81 | 7.39 | -0.51% | 12.58% |

INTC | 131.8B | 55.2B | 2.72% | -5.96% | 32.4 | 2.39 | -2.09% | 242.32% |

ADI | 113.3B | 10.5B | 0.07% | 20.49% | 52.93 | 10.83 | -18.69% | -40.94% |

| MID-CAP | ||||||||

AMKR | 9.9B | 6.4B | 23.02% | 34.88% | 26.39 | 1.54 | -8.17% | -41.71% |

CRUS | 6.8B | 1.8B | 10.88% | 60.21% | 24.91 | 3.82 | -5.73% | 55.39% |

ACLS | 4.6B | 1.1B | 26.20% | -20.42% | 18.49 | 4.1 | 16.34% | 32.25% |

DIOD | 3.3B | 1.5B | 0.22% | -21.26% | 19.51 | 2.22 | -24.64% | -48.42% |

AMBA | 2.2B | 218.8M | 9.68% | -34.80% | -12.9 | 10.11 | -29.29% | -89.52% |

| SMALL-CAP | ||||||||

ACMR | 1.4B | 635.7M | 1.95% | 72.35% | 16.15 | 2.23 | 51.02% | 67.91% |

AOSL | 1.1B | 657.5M | 26.94% | 15.06% | -113.46 | 1.63 | -9.15% | -119.91% |

AEHR | 323.0M | 71.9M | 1.09% | -72.10% | 20.97 | 4.49 | 14.14% | 8.17% |

ATOM | 102.4M | 550.0K | -11.29% | -55.65% | -5.23 | 186.26 | 43.98% | -6.63% |

ASYS | 83.8M | 108.8M | 6.88% | -35.59% | -3.91 | 0.77 | 1.54% | -244.16% |

NXP Semiconductors NV News

NXP Semiconductors NV Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | -8.6% | 3,126 | 3,422 | 3,434 | 3,299 | 3,121 | 3,312 | 3,445 | 3,312 | 3,136 | 3,039 | 2,861 | 2,596 | 2,567 | 2,507 | 2,267 | 1,817 | 2,021 | 2,301 | 2,265 | 2,217 | 2,094 |

| Cost Of Revenue | -9.6% | 1,343 | 1,485 | 1,469 | 1,418 | 1,351 | 1,421 | 1,478 | 1,430 | 1,359 | 1,332 | 1,278 | 1,174 | 1,212 | 1,219 | 1,177 | 957 | 1,024 | 1,092 | 1,079 | 1,066 | 1,022 |

| Gross Profit | -8.0% | 1,783 | 1,937 | 1,965 | 1,881 | 1,770 | 1,891 | 1,967 | 1,882 | 1,777 | 1,707 | 1,583 | 1,422 | 1,355 | 1,288 | 1,090 | 860 | 997 | 1,209 | 1,186 | 1,151 | 1,072 |

| Operating Expenses | -10.1% | 921 | 1,025 | 966 | 944 | 942 | 910 | 968 | 941 | 904 | 900 | 872 | 849 | 863 | 829 | 1,059 | 1,004 | 1,039 | 1,014 | 975 | 993 | 1,020 |

| S&GA Expenses | -1.6% | 306 | 311 | 294 | 274 | 280 | 261 | 289 | 265 | 251 | 257 | 243 | 234 | 222 | 221 | 203 | 222 | 233 | 225 | 221 | 230 | 248 |

| R&D Expenses | -13.4% | 564 | 651 | 601 | 589 | 577 | 540 | 548 | 542 | 518 | 507 | 492 | 476 | 461 | 460 | 438 | 402 | 425 | 424 | 396 | 408 | 415 |

| EBITDA Margin | -0.5% | 0.35* | 0.36* | 0.37* | 0.37* | 0.37* | 0.37* | 0.37* | 0.36* | 0.35* | 0.34* | 0.33* | 0.30* | - | - | - | - | - | - | - | - | - |

| Interest Expenses | -54.2% | 38.00 | 83.00 | 38.00 | 86.00 | 54.00 | 106 | 39.00 | 133 | 45.00 | 140 | 56.00 | 104 | 56.00 | 125 | 54.00 | 104 | 53.00 | 95.00 | 44.00 | 78.00 | 25.00 |

| Income Taxes | 13.7% | 141 | 124 | 123 | 158 | 118 | 137 | 149 | 129 | 114 | -24.00 | 95.00 | 65.00 | 40.00 | 5.00 | -57.00 | -33.00 | 2.00 | -20.00 | 28.00 | 21.00 | -9.00 |

| Earnings Before Taxes | -5.2% | 786 | 829 | 917 | 863 | 743 | 877 | 903 | 815 | 768 | 684 | 618 | 473 | 405 | 326 | -74.00 | -241 | -10.00 | 104 | 148 | 68.00 | -29.00 |

| EBT Margin | 1.2% | 0.26* | 0.25* | 0.26* | 0.26* | 0.25* | 0.25* | 0.25* | 0.23* | 0.22* | 0.20* | 0.17* | 0.11* | - | - | - | - | - | - | - | - | - |

| Net Income | -7.9% | 639 | 694 | 787 | 704 | 615 | 711 | 738 | 683 | 666 | 592 | 519 | 406 | 364 | 303 | -22.00 | -209 | -13.00 | 109 | 109 | 46.00 | -16.00 |

| Net Income Margin | 0.8% | 0.21* | 0.21* | 0.21* | 0.21* | 0.21* | 0.21* | 0.21* | 0.20* | 0.19* | 0.17* | 0.15* | 0.11* | - | - | - | - | - | - | - | - | - |

| Free Cashflow | -35.0% | 625 | 962 | 788 | 555 | 381 | 843 | 862 | 551 | 576 | 519 | 723 | 486 | - | - | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | -4.2% | 23,320 | 24,353 | 23,996 | 23,795 | 23,732 | 23,236 | 22,940 | 22,539 | 21,321 | 20,864 | 20,010 | 20,622 | 19,392 | 19,847 | 21,122 | 21,057 | 19,511 | 20,016 | 21,254 | 21,346 | 21,438 |

| Current Assets | -12.3% | 6,894 | 7,864 | 7,616 | 7,447 | 7,357 | 6,935 | 6,703 | 6,320 | 5,275 | 5,228 | 4,721 | 5,291 | 4,024 | 4,324 | 5,604 | 5,215 | 3,249 | 3,267 | 5,944 | - | - |

| Cash Equivalents | -24.7% | 2,908 | 3,862 | 4,042 | 3,863 | 3,930 | 3,845 | 3,759 | 3,545 | 2,683 | 2,830 | 2,303 | 2,910 | 1,842 | 2,275 | 3,566 | 3,266 | 1,079 | 1,045 | 3,537 | 3,030 | 2,192 |

| Inventory | -1.5% | 2,102 | 2,134 | 2,140 | 2,107 | 1,977 | 1,782 | 1,581 | 1,462 | 1,311 | 1,189 | 1,173 | 1,116 | 1,056 | 1,030 | 1,064 | 1,228 | 1,227 | 1,192 | 1,134 | - | - |

| Net PPE | -0.6% | 3,304 | 3,323 | 3,197 | 3,152 | 3,123 | 3,105 | 2,971 | 2,914 | 2,814 | 2,635 | 2,510 | 2,375 | 2,304 | 2,284 | 2,255 | 2,312 | 2,397 | 2,448 | 2,401 | - | - |

| Goodwill | -0.1% | 9,945 | 9,955 | 9,937 | 9,950 | 9,949 | 9,943 | 9,909 | 9,930 | 9,954 | 9,961 | 9,968 | 9,971 | 9,968 | 9,984 | 9,959 | 9,946 | 9,935 | 9,949 | 8,791 | - | - |

| Liabilities | -7.9% | 14,170 | 15,393 | 15,198 | 15,318 | 15,484 | 15,496 | 15,555 | 15,313 | 14,561 | 14,094 | 13,038 | 12,953 | 10,871 | 10,696 | 12,049 | 12,002 | 10,253 | 10,361 | 11,659 | - | - |

| Current Liabilities | -28.8% | 2,928 | 4,111 | 3,964 | 4,085 | 4,213 | 3,270 | 3,219 | 2,941 | 2,845 | 2,452 | 3,438 | 2,336 | 2,265 | 2,017 | 3,411 | 2,992 | 1,831 | 1,791 | 3,126 | - | - |

| Long Term Debt | 0.0% | 10,178 | 10,175 | 10,173 | 10,171 | 10,169 | 11,165 | 11,162 | 11,160 | 10,573 | 10,572 | 8,594 | 9,591 | 7,611 | 7,609 | 7,607 | 8,004 | 7,366 | 7,365 | 7,363 | - | - |

| Shareholder's Equity | 2.1% | 8,829 | 8,644 | 8,488 | 8,477 | 8,248 | 7,740 | 7,385 | 7,226 | 6,760 | 6,770 | 6,972 | 7,669 | 8,521 | 9,151 | 9,073 | 9,055 | 9,258 | 9,655 | 9,595 | 9,520 | 9,931 |

| Retained Earnings | 13.3% | -2,421 | -2,793 | -2,725 | -3,228 | -3,652 | -3,975 | -4,039 | -4,522 | -4,959 | -5,371 | -3,730 | -3,897 | -4,136 | -4,328 | -3,313 | -3,155 | -2,933 | -2,845 | -2,037 | - | - |

| Additional Paid-In Capital | 0.8% | 14,619 | 14,501 | 14,398 | 14,291 | 14,192 | 14,091 | 13,996 | 13,904 | 13,819 | 13,727 | 14,392 | 14,312 | 14,224 | 14,133 | 15,314 | 15,228 | 15,236 | 15,184 | 15,722 | - | - |

| Accumulated Depreciation | 2.2% | 5,783 | 5,660 | 5,525 | - | 5,350 | 5,214 | 5,055 | 5,396 | 4,805 | 4,676 | 4,565 | 4,461 | 4,344 | 4,237 | 4,110 | 3,977 | 3,842 | 3,742 | 3,632 | - | - |

| Shares Outstanding | -0.7% | 257 | 258 | 257 | 259 | 260 | 262 | 263 | 263 | 263 | 271 | 267 | 273 | - | - | - | - | - | - | - | - | - |

| Minority Interest | 1.6% | 321 | 316 | 310 | 305 | 299 | 291 | 279 | 264 | 251 | 242 | 234 | 227 | 218 | 207 | 197 | 193 | 222 | 214 | 205 | - | - |

| Float | - | - | - | - | 52,900 | - | - | - | 38,400 | - | - | - | 54,700 | - | - | - | 30,200 | - | - | - | 27,200 | - |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | -25.2% | 851 | 1,137 | 988 | 756 | 632 | 1,076 | 1,144 | 819 | 856 | 785 | 924 | 636 | 732 | 1,029 | 527 | 414 | 512 | 814 | 746 | 517 | 296 |

| Share Based Compensation | 7.5% | 115 | 107 | 103 | 102 | 99.00 | 97.00 | 89.00 | 89.00 | 89.00 | 88.00 | 81.00 | 93.00 | 91.00 | 89.00 | 83.00 | 105 | 107 | 89.00 | 84.00 | 87.00 | 86.00 |

| Cashflow From Investing | 56.4% | -274 | -629 | -273 | -255 | -351 | -272 | -360 | -288 | -329 | -316 | -248 | -189 | -181 | -163 | -105 | -113 | -37.00 | -1,866 | -138 | -144 | -136 |

| Cashflow From Financing | -120.2% | -1,528 | -694 | -533 | -565 | -198 | -728 | -559 | 342 | -674 | 55.00 | -1,280 | 619 | -979 | -2,165 | -124 | 1,885 | -431 | -1,443 | -95.00 | 463 | -756 |

| Dividend Payments | 0% | 261 | 261 | 262 | 264 | 219 | 221 | 223 | 222 | 149 | 150 | 152 | 155 | 105 | 105 | 105 | 105 | 105 | 105 | 70.00 | 71.00 | 73.00 |

| Buy Backs | -30.2% | 303 | 434 | 306 | 302 | 11.00 | 506 | 366 | 2.00 | 552 | 750 | 1,157 | 1,203 | 905 | 257 | 12.00 | 3.00 | 355 | 74.00 | 9.00 | 645 | 715 |

NXPI Income Statement

2024-03-31CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) - USD ($) shares in Thousands, $ in Millions | 3 Months Ended | |

|---|---|---|

Mar. 31, 2024 | Apr. 02, 2023 | |

| Income Statement [Abstract] | ||

| Revenue | $ 3,126 | $ 3,121 |

| Cost of revenue | (1,343) | (1,351) |

| Gross profit | 1,783 | 1,770 |

| Research and development | (564) | (577) |

| Selling, general and administrative | (306) | (280) |

| Amortization of acquisition-related intangible assets | (51) | (85) |

| Total operating expenses | (921) | (942) |

| Other income (expense) | (6) | (3) |

| Operating income (loss) | 856 | 825 |

| Financial income (expense): | ||

| Other financial income (expense) | (70) | (82) |

| Income (loss) before income taxes | 786 | 743 |

| Benefit (provision) for income taxes | (141) | (118) |

| Results relating to equity-accounted investees | (1) | (2) |

| Net income (loss) | 644 | 623 |

| Less: Net income (loss) attributable to non-controlling interests | 5 | 8 |

| Net income (loss) attributable to stockholders | $ 639 | $ 615 |

| Earnings per share data: | ||

| Basic net income (loss) (in dollars per share) | $ 2.49 | $ 2.37 |

| Diluted net income (loss) (in dollars per share) | $ 2.47 | $ 2.35 |

| Weighted average number of shares of common stock outstanding during the period (in thousands): | ||

| Basic (in shares) | 256,567 | 259,576 |

| Diluted (in shares) | 258,954 | 261,210 |

| (Gain) loss on extinguishment of debt | $ 0 | $ 0 |

NXPI Balance Sheet

2024-03-31CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) $ in Millions | Mar. 31, 2024 USD ($) | Dec. 31, 2023 USD ($) |

|---|---|---|

| Current assets: | ||

| Cash and cash equivalents | $ 2,908 | $ 3,862 |

| Deposits Assets, Current | 400 | 409 |

| Accounts receivable, net | 881 | 894 |

| Inventories, net | 2,102 | 2,134 |

| Other current assets | 603 | 565 |

| Total current assets | 6,894 | 7,864 |

| Non-current assets: | ||

| Other non-current assets | 2,338 | 2,289 |

| Property, plant and equipment, net of accumulated depreciation of $5,783 and $5,660 | 3,304 | 3,323 |

| Identified intangible assets, net of accumulated amortization of $1,326 and $1,342 | 839 | 922 |

| Goodwill | 9,945 | 9,955 |

| Total non-current assets | 16,426 | 16,489 |

| Total assets | 23,320 | 24,353 |

| Current liabilities: | ||

| Accounts payable | 954 | 1,164 |

| Restructuring liabilities-current | 68 | 92 |

| Other current liabilities | 1,906 | 1,855 |

| Short-term debt | 0 | 1,000 |

| Total current liabilities | 2,928 | 4,111 |

| Non-current liabilities: | ||

| Long-term debt | 10,178 | 10,175 |

| Restructuring liabilities | 9 | 9 |

| Deferred tax liabilities | 46 | 44 |

| Other non-current liabilities | 1,009 | 1,054 |

| Total non-current liabilities | 11,242 | 11,282 |

| Total liabilities | 14,170 | 15,393 |

| Equity: | ||

| Non-controlling interests | 321 | 316 |

| Stockholders’ equity: | ||

| Common stock, par value €0.20 per share: | 56 | 56 |

| Capital in excess of par value | 14,619 | 14,501 |

| Treasury shares, at cost : 36,518,520 shares (2019: 34,082,242 shares) | (3,469) | (3,210) |

| Accumulated other comprehensive income (loss) | 44 | 90 |

| Accumulated deficit | (2,421) | (2,793) |

| Total stockholders’ equity | 8,829 | 8,644 |

| Total equity | 9,150 | 8,960 |

| Total liabilities and equity | $ 23,320 | $ 24,353 |

| CEO | Mr. Kurt Sievers |

|---|---|

| WEBSITE | nxp.com |

| INDUSTRY | Semiconductors |

| EMPLOYEES | 34500 |