Market Summary

TECH Stock Price

TECH RSI Chart

TECH Valuation

TECH Price/Sales (Trailing)

TECH Profitability

TECH Fundamentals

TECH Revenue

TECH Earnings

Breaking Down TECH Revenue

Last 7 days

4.9%

Last 30 days

12.9%

Last 90 days

13.3%

Trailing 12 Months

-5.0%

How does TECH drawdown profile look like?

TECH Financial Health

TECH Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 1.2B | 0 | 0 | 0 |

| 2023 | 1.1B | 1.1B | 1.1B | 1.1B |

| 2022 | 1.1B | 1.1B | 1.1B | 1.1B |

| 2021 | 847.8M | 931.0M | 984.6M | 1.0B |

| 2020 | 754.5M | 738.7M | 759.6M | 799.0M |

| 2019 | 702.6M | 714.0M | 734.3M | 744.7M |

| 2018 | 619.3M | 643.0M | 661.4M | 681.7M |

| 2017 | 541.2M | 563.0M | 577.0M | 599.4M |

| 2016 | 481.9M | 499.0M | 517.2M | 528.1M |

| 2015 | 434.3M | 452.2M | 456.1M | 465.1M |

| 2014 | 344.7M | 357.8M | 380.6M | 398.5M |

| 2013 | 309.8M | 310.6M | 321.2M | 330.2M |

| 2012 | 313.9M | 314.6M | 312.0M | 312.4M |

| 2011 | 278.6M | 290.0M | 299.6M | 306.6M |

| 2010 | 267.8M | 269.0M | 270.5M | 272.6M |

| 2009 | 0 | 264.0M | 265.2M | 266.5M |

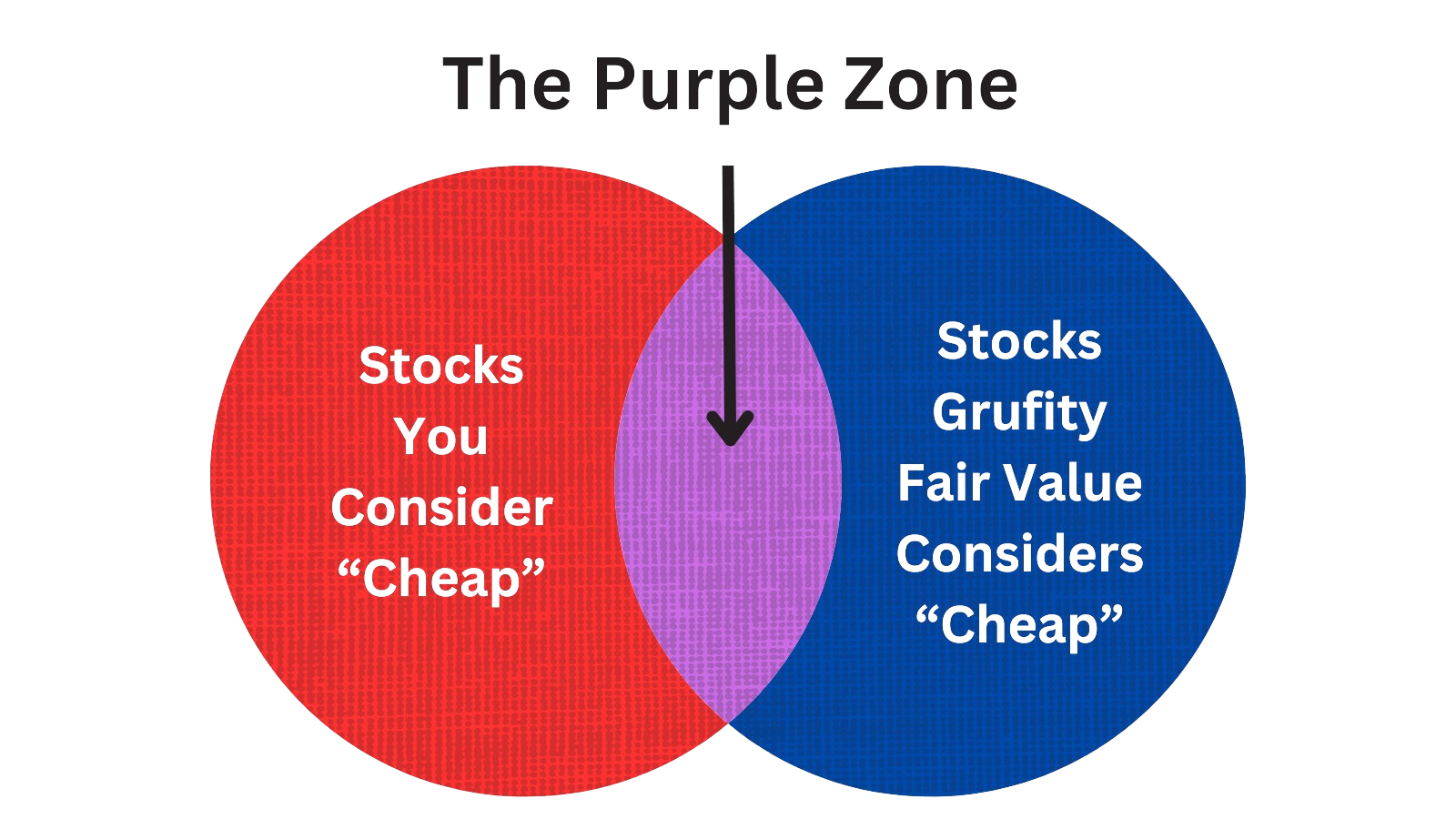

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of Bio-Techne Corp

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| May 01, 2024 | klimovsky judith v | acquired | - | - | 680 | - |

| Apr 03, 2024 | bohnen shane | acquired | - | - | 2,259 | svp - general counsel |

| Apr 03, 2024 | bohnen shane | sold (taxes) | -50,698 | 67.87 | -747 | svp - general counsel |

| Mar 07, 2024 | nusse roeland | sold | -800,627 | 76.9834 | -10,400 | - |

| Feb 01, 2024 | geist william | sold (taxes) | -76,147 | 68.54 | -1,111 | president, protein sciences |

| Dec 19, 2023 | hippel james | acquired | 1,478,250 | 31.26 | 47,289 | cfo |

| Dec 19, 2023 | hippel james | sold (taxes) | -2,552,230 | 77.42 | -32,966 | cfo |

| Nov 01, 2023 | kelderman kim | acquired | - | - | 14,196 | chief operating officer |

| Oct 26, 2023 | vessey rupert | acquired | - | - | 1,625 | - |

| Oct 26, 2023 | higgins john l | acquired | - | - | 1,625 | - |

Which funds bought or sold TECH recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 07, 2024 | M&T Bank Corp | added | 5.12 | -41,646 | 978,733 | -% |

| May 07, 2024 | Aull & Monroe Investment Management Corp | sold off | -100 | -216,048 | - | -% |

| May 07, 2024 | MONTAG A & ASSOCIATES INC | new | - | 1,380 | 1,380 | -% |

| May 07, 2024 | CIM INVESTMENT MANAGEMENT INC | unchanged | - | -23,594 | 245,309 | 0.07% |

| May 07, 2024 | Washington Trust Advisors, Inc. | unchanged | - | -338 | 3,520 | -% |

| May 07, 2024 | MEEDER ASSET MANAGEMENT INC | reduced | -80.74 | -148,570 | 31,676 | -% |

| May 07, 2024 | NEW YORK STATE COMMON RETIREMENT FUND | reduced | -1.87 | -5,197,000 | 44,407,000 | 0.06% |

| May 07, 2024 | NorthRock Partners, LLC | added | 69.29 | 195,075 | 553,406 | 0.05% |

| May 07, 2024 | SUSQUEHANNA INTERNATIONAL GROUP, LLP | added | 7.71 | -60,133 | 3,402,650 | -% |

| May 07, 2024 | FORSTA AP-FONDEN | added | 16.61 | 145,196 | 2,421,420 | 0.02% |

Are Funds Buying or Selling TECH?

Unveiling Bio-Techne Corp's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 13, 2024 | vanguard group inc | 11.53% | 18,228,210 | SC 13G/A | |

| Jan 24, 2024 | blackrock inc. | 11.5% | 18,133,912 | SC 13G/A | |

| Feb 09, 2023 | vanguard group inc | 11.59% | 18,199,432 | SC 13G/A | |

| Jan 26, 2023 | blackrock inc. | 10.1% | 15,888,640 | SC 13G/A | |

| Jan 20, 2023 | blackrock inc. | 10.1% | 15,888,640 | SC 13G | |

| Feb 09, 2022 | vanguard group inc | 11.27% | 4,426,638 | SC 13G/A | |

| Jan 27, 2022 | blackrock inc. | 11.0% | 4,328,299 | SC 13G/A | |

| Jan 25, 2022 | blackrock inc. | 11.0% | 4,328,299 | SC 13G/A | |

| Sep 10, 2021 | vanguard group inc | 11.04% | 4,315,543 | SC 13G/A | |

| Feb 10, 2021 | vanguard group inc | 9.30% | 3,591,352 | SC 13G/A |

Recent SEC filings of Bio-Techne Corp

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 06, 2024 | 10-Q | Quarterly Report | |

| May 03, 2024 | 4 | Insider Trading | |

| May 03, 2024 | 3 | Insider Trading | |

| May 01, 2024 | 8-K | Current Report | |

| Apr 30, 2024 | 8-K | Current Report | |

| Apr 05, 2024 | 4 | Insider Trading | |

| Mar 11, 2024 | 4 | Insider Trading | |

| Mar 07, 2024 | 144 | Notice of Insider Sale Intent | |

| Feb 13, 2024 | SC 13G/A | Major Ownership Report | |

| Feb 07, 2024 | 10-Q | Quarterly Report |

Peers (Alternatives to Bio-Techne Corp)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

MRNA | 46.7B | 6.8B | 16.03% | -8.84% | -7.83 | 6.82 | -64.45% | -224.75% |

HILS | 22.4B | 152.6K | -0.77% | 465779.94% | -2.4K | 146.8K | - | -9.98% |

ALNY | 19.3B | 2.0B | -2.41% | -26.73% | -58.01 | 9.62 | 75.20% | 68.82% |

BMRN | 15.5B | 2.5B | -6.28% | -14.44% | 75.6 | 6.28 | 13.74% | 186.89% |

INCY | 12.0B | 3.8B | -2.82% | -17.40% | 16.12 | 3.19 | 8.58% | 129.81% |

| MID-CAP | ||||||||

BBIO | 5.2B | 107.9M | -2.02% | 101.31% | -9.48 | 48.09 | 54.84% | -28.31% |

APLS | 5.1B | 524.1M | -21.41% | -52.73% | -12.3 | 9.79 | 394.93% | 39.61% |

AXSM | 3.6B | 251.0M | 5.14% | -1.20% | -12.15 | 14.35 | 73.58% | -86.73% |

ARWR | 3.1B | 240.7M | -1.87% | -37.68% | -10.53 | 12.18 | -1.03% | -92.09% |

ACAD | 2.8B | 726.4M | -3.99% | -20.25% | -45.95 | 3.88 | 40.45% | 71.62% |

| SMALL-CAP | ||||||||

CPRX | 1.7B | 411.3M | -5.16% | -15.46% | 26.68 | 4.22 | 60.38% | -34.49% |

NVAX | 625.6M | 983.7M | 0.90% | -53.05% | -1.15 | 0.64 | -50.36% | 17.16% |

CRBP | 451.6M | 881.7K | 5.23% | 376.44% | -13.38 | 481.06 | -77.61% | 33.36% |

INO | 257.1M | 4.9M | -3.00% | 9.13% | -1.9 | 52.83 | -54.97% | 51.71% |

IBIO | 6.6M | 2.1M | -15.93% | 74.31% | -0.24 | 2.14 | -13.45% | 66.37% |

Bio-Techne Corp News

Bio-Techne Corp Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | 11.3% | 303 | 273 | 277 | 301 | 294 | 272 | 270 | 288 | 290 | 269 | 258 | 259 | 244 | 224 | 204 | 176 | 195 | 185 | 183 | 192 | 185 |

| Gross Profit | 15.9% | 205 | 177 | 185 | 205 | 202 | 183 | 180 | 200 | 201 | 184 | 171 | 176 | 168 | 151 | 138 | 113 | 130 | 121 | 118 | 128 | 125 |

| Operating Expenses | -0.7% | 138 | 139 | 129 | 110 | 122 | 115 | 123 | 120 | 111 | 121 | 108 | 107 | 100 | 100 | 89.00 | 74.00 | 82.00 | 84.00 | 85.00 | 85.00 | 81.00 |

| S&GA Expenses | -3.3% | 112 | 116 | 105 | 87.00 | 99.00 | 93.00 | 99.00 | 97.00 | 89.00 | 101 | 86.00 | 87.00 | 83.00 | 83.00 | 73.00 | 57.00 | 66.00 | 68.00 | 69.00 | 69.00 | 65.00 |

| EBITDA Margin | -5.0% | 0.31* | 0.33* | 0.36* | 0.40* | 0.40* | 0.39* | 0.40* | 0.37* | 0.32* | 0.30* | 0.28* | 0.27* | - | - | - | - | - | - | - | - | - |

| Interest Expenses | -1.8% | 4.00 | 4.00 | 5.00 | 5.00 | 1.00 | 2.00 | 3.00 | 3.00 | 2.00 | 3.00 | 3.00 | 3.00 | 3.00 | 4.00 | 4.00 | 5.00 | 4.00 | 5.00 | 5.00 | 5.00 | -2.52 |

| Income Taxes | 103.1% | 12.00 | 6.00 | -1.43 | 13.00 | 10.00 | 16.00 | 14.00 | 17.00 | 9.00 | 14.00 | -1.60 | -7.53 | -0.05 | 10.00 | 6.00 | 3.00 | 10.00 | 31.00 | 3.00 | 6.00 | 5.00 |

| Earnings Before Taxes | 83.0% | 61.00 | 33.00 | 50.00 | 88.00 | 80.00 | 66.00 | 104 | 79.00 | 69.00 | 86.00 | 67.00 | 7.00 | 45.00 | 56.00 | 39.00 | 62.00 | 47.00 | 150 | 18.00 | 23.00 | 50.00 |

| EBT Margin | -8.3% | 0.20* | 0.22* | 0.25* | 0.30* | 0.29* | 0.28* | 0.30* | 0.27* | 0.21* | 0.20* | 0.18* | 0.16* | - | - | - | - | - | - | - | - | - |

| Net Income | 78.6% | 49.00 | 27.00 | 51.00 | 75.00 | 70.00 | 50.00 | 90.00 | 66.00 | 61.00 | 72.00 | 69.00 | 15.00 | 46.00 | 46.00 | 33.00 | 59.00 | 36.00 | 120 | 14.00 | 16.00 | 45.00 |

| Net Income Margin | -10.2% | 0.18* | 0.20* | 0.22* | 0.25* | 0.25* | 0.24* | 0.26* | 0.24* | 0.20* | 0.20* | 0.18* | 0.15* | - | - | - | - | - | - | - | - | - |

| Free Cashflow | -5.4% | 65.00 | 68.00 | 46.00 | 73.00 | 39.00 | 58.00 | 47.00 | 89.00 | 58.00 | 91.00 | 42.00 | 111 | - | - | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | -0.4% | 2,721 | 2,731 | 2,755 | 2,639 | 2,600 | 2,363 | 2,351 | 2,295 | 2,300 | 2,305 | 2,270 | 2,263 | 2,085 | 2,068 | 2,053 | 2,028 | 1,999 | 1,998 | 1,925 | 1,884 | 1,873 |

| Current Assets | 3.4% | 611 | 591 | 591 | 621 | 571 | 565 | 552 | 606 | 593 | 590 | 544 | 511 | 567 | 542 | 542 | 521 | 492 | 465 | 392 | 413 | 423 |

| Cash Equivalents | 7.5% | 140 | 130 | 149 | 181 | 127 | 165 | 165 | 173 | 161 | 212 | 196 | 199 | 186 | 166 | 169 | 147 | 156 | 110 | 100 | 101 | 96.00 |

| Inventory | -0.7% | 179 | 181 | 186 | 172 | 169 | 160 | 150 | 141 | 128 | 122 | 117 | 117 | 110 | 107 | 106 | 103 | 100 | 95.00 | 91.00 | 91.00 | 94.00 |

| Net PPE | 4.1% | 244 | 234 | 232 | 226 | 224 | 224 | 224 | 223 | 218 | 212 | 207 | 208 | 199 | 196 | 192 | 177 | 165 | 164 | 157 | 154 | 145 |

| Goodwill | -0.9% | 971 | 980 | 969 | 873 | 871 | 870 | 865 | 822 | 828 | 832 | 843 | 843 | 95.00 | 728 | 732 | 728 | 726 | 734 | 730 | 733 | 720 |

| Current Liabilities | 10.8% | 150 | 135 | 128 | 129 | 141 | 128 | 138 | 176 | 167 | 155 | 134 | 152 | 138 | 118 | 105 | 107 | 105 | 105 | 88.00 | 102 | 98.00 |

| Long Term Debt | -13.0% | 389 | 447 | 440 | 350 | 370 | 200 | 265 | 243 | 247 | 270 | 288 | 329 | 203 | 219 | 311 | 344 | 407 | 370 | 474 | 493 | 510 |

| LT Debt, Current | - | - | - | - | - | - | - | - | 13.00 | 13.00 | 13.00 | 13.00 | 13.00 | 13.00 | 13.00 | 13.00 | 13.00 | 13.00 | 13.00 | 13.00 | 13.00 | 13.00 |

| Shareholder's Equity | 2.6% | 2,014 | 1,964 | 1,998 | 1,967 | 1,890 | 12.00 | 13.00 | 1,701 | 1,713 | 1,703 | 1,647 | 1,571 | 1,548 | 1,531 | 1,439 | 1,381 | 1,291 | 1,323 | 1,174 | 1,166 | 1,146 |

| Retained Earnings | 2.9% | 1,298 | 1,261 | 1,328 | 1,309 | 1,247 | 1,200 | 1,163 | 1,123 | 1,133 | 1,146 | 1,119 | 1,085 | 1,089 | 1,105 | 1,073 | 1,057 | 1,013 | 1,039 | 931 | 932 | 928 |

| Additional Paid-In Capital | 3.4% | 790 | 764 | 747 | 722 | 715 | 701 | 680 | 652 | 636 | 616 | 584 | 534 | 514 | 481 | 449 | 421 | 382 | 363 | 334 | 317 | 298 |

| Accumulated Depreciation | - | 252 | - | - | 234 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - |

| Shares Outstanding | 0.3% | 158 | 157 | 158 | 158 | 157 | 157 | 157 | 157 | 157 | 157 | 156 | 155 | - | - | - | - | - | - | - | - | - |

| Minority Interest | - | - | - | - | - | - | - | - | -0.76 | -1.05 | -0.46 | 8.00 | 8.00 | 8.00 | 9.00 | - | - | - | - | - | - | - |

| Float | - | - | - | - | - | - | 13,000 | - | - | - | 20,300 | - | - | - | 12,400 | - | - | - | 8,400 | - | - | - |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | -2.6% | 81.00 | 83.00 | 59.00 | 83.00 | 51.00 | 64.00 | 56.00 | 103 | 73.00 | 101 | 48.00 | 122 | 75.00 | 89.00 | 66.00 | 45.00 | 49.00 | 70.00 | 41.00 | 56.00 | 40.00 |

| Share Based Compensation | -36.2% | 8.00 | 13.00 | 10.00 | -2.08 | 10.00 | 17.00 | 14.00 | 8.00 | 8.00 | 14.00 | 12.00 | 10.00 | 11.00 | 16.00 | 13.00 | 6.00 | 8.00 | 10.00 | 8.00 | 8.00 | 6.00 |

| Cashflow From Investing | 30.5% | -16.44 | -23.67 | -154 | -4.76 | -241 | -0.11 | -19.69 | -18.57 | -35.99 | -35.17 | -7.12 | -226 | 0.00 | -8.60 | -8.14 | -10.47 | 19.00 | 33.00 | -15.08 | -30.32 | -4.74 |

| Cashflow From Financing | 35.6% | -52.42 | -81.40 | 72.00 | -24.22 | 151 | -72.19 | -31.81 | -65.73 | -84.06 | -53.38 | -39.68 | 118 | -55.23 | -90.08 | -34.93 | -44.72 | -17.79 | -97.03 | -24.27 | -19.90 | -27.04 |

| Dividend Payments | -100.0% | - | 13.00 | 13.00 | 13.00 | 13.00 | 13.00 | 13.00 | 13.00 | 13.00 | 13.00 | 12.00 | 12.00 | 12.00 | 12.00 | 12.00 | 12.00 | 12.00 | 12.00 | 12.00 | 12.00 | 12.00 |

| Buy Backs | - | - | - | - | - | - | - | 20.00 | 59.00 | 61.00 | - | - | - | 43.00 | - | - | - | 50.00 | - | - | - | 0.00 |

TECH Income Statement

2024-03-31CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS AND COMPREHENSIVE INCOME - USD ($) shares in Thousands, $ in Thousands | 3 Months Ended | 9 Months Ended | ||

|---|---|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | Mar. 31, 2024 | Mar. 31, 2023 | |

| CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS AND COMPREHENSIVE INCOME | ||||

| Net sales | $ 303,428 | $ 294,146 | $ 852,961 | $ 835,382 |

| Cost of sales | 98,829 | 91,984 | 286,584 | 270,265 |

| Gross margin | 204,599 | 202,162 | 566,377 | 565,117 |

| Operating expenses: | ||||

| Selling, general and administrative | 111,840 | 99,238 | 332,839 | 291,624 |

| Research and development | 25,761 | 22,713 | 72,675 | 69,074 |

| Total operating expenses | 137,601 | 121,951 | 405,514 | 360,698 |

| Operating income | 66,998 | 80,211 | 160,863 | 204,419 |

| Other income (expense) | (5,914) | (15) | (16,835) | 45,924 |

| Earnings before income taxes | 61,084 | 80,196 | 144,028 | 250,343 |

| Income taxes | 12,025 | 9,978 | 16,511 | 40,385 |

| Net earnings, including noncontrolling interest | 49,059 | 70,218 | 127,517 | 209,958 |

| Net earnings attributable to noncontrolling interest | 0 | 0 | 0 | 179 |

| Net earnings attributable to Bio-Techne | 49,059 | 70,218 | 127,517 | 209,779 |

| Other comprehensive income (loss): | ||||

| Foreign currency translation income (loss) | (11,981) | 3,282 | (5,558) | (805) |

| Foreign currency translation reclassified to earnings with Eminence deconsolidation | 0 | 0 | 0 | 119 |

| Unrealized gains (losses) on derivative instruments - cash flow hedges, net of tax amounts disclosed in Note 8 | 335 | (1,708) | (3,685) | 2,302 |

| Other comprehensive income (loss) | (11,646) | 1,574 | (9,243) | 1,616 |

| Other comprehensive income (loss) attributable to noncontrolling interest | 0 | 0 | 0 | (33) |

| Other comprehensive income (loss) attributable to Bio-Techne | (11,646) | 1,574 | (9,243) | 1,649 |

| Comprehensive income attributable to Bio-Techne | $ 37,413 | $ 71,792 | $ 118,274 | $ 211,428 |

| Earnings per share attributable to Bio-Techne: | ||||

| Basic (in dollars per share) | $ 0.31 | $ 0.45 | $ 0.81 | $ 1.34 |

| Diluted (in dollars per share) | $ 0.31 | $ 0.43 | $ 0.79 | $ 1.30 |

| Weighted average common shares outstanding: | ||||

| Basic (in shares) | 157,309 | 157,311 | 157,655 | 157,071 |

| Diluted (in shares) | 160,496 | 161,615 | 160,817 | 161,768 |

TECH Balance Sheet

2024-03-31CONDENSED CONSOLIDATED BALANCE SHEETS - USD ($) $ in Thousands | Mar. 31, 2024 | Jun. 30, 2023 |

|---|---|---|

| Current assets: | ||

| Cash and cash equivalents | $ 139,915 | $ 180,571 |

| Short-term available-for-sale investments | 5,397 | 23,739 |

| Accounts receivable, less allowance for doubtful accounts of $3,293 and $4,738, respectively | 227,887 | 218,468 |

| Inventories | 179,496 | 171,638 |

| Current assets held-for-sale | 26,669 | 0 |

| Other current assets | 31,286 | 27,066 |

| Total current assets | 610,650 | 621,482 |

| Property and equipment, net | 243,728 | 226,200 |

| Right-of-use assets | 97,258 | 98,326 |

| Goodwill | 970,966 | 872,737 |

| Intangible assets, net | 526,428 | 534,645 |

| Other assets | 272,140 | 285,302 |

| Total assets | 2,721,170 | 2,638,692 |

| Current liabilities: | ||

| Trade accounts payable | 28,895 | 25,679 |

| Salaries, wages and related accruals | 44,313 | 36,747 |

| Accrued expenses | 17,806 | 14,880 |

| Contract liabilities | 30,108 | 23,069 |

| Income taxes payable | 12,082 | 12,022 |

| Operating lease liabilities - current | 12,978 | 11,199 |

| Contingent consideration payable | 0 | 3,500 |

| Current liabilities held-for-sale | 689 | 0 |

| Other current liabilities | 2,949 | 1,413 |

| Total current liabilities | 149,820 | 128,509 |

| Deferred income taxes | 63,666 | 88,982 |

| Long-term debt obligations | 389,000 | 350,000 |

| Operating lease liabilities | 92,752 | 93,766 |

| Other long-term liabilities | 11,557 | 10,919 |

| Bio-Techne's Shareholders' equity: | ||

| Undesignated capital stock, no par; authorized 5,000,000 shares; none issued or outstanding | 0 | 0 |

| Common stock, par value $.01 per share; authorized 400,000,000; issued and outstanding 157,554,366 and 157,641,914 respectively | 1,576 | 1,576 |

| Additional paid-in capital | 790,418 | 721,543 |

| Retained earnings | 1,297,688 | 1,309,461 |

| Accumulated other comprehensive loss | (75,307) | (66,064) |

| Total Bio-Techne's shareholders' equity | 2,014,375 | 1,966,516 |

| Total liabilities and shareholders' equity | $ 2,721,170 | $ 2,638,692 |

| CEO | Mr. Charles R. Kummeth |

|---|---|

| WEBSITE | bio-techne.com |

| INDUSTRY | Biotechnology |

| EMPLOYEES | 3050 |